Im in the process of saving every bit i can and looking to the future to buy a home, i wanted to see what tips and ideals and knowledge current and future home owners and people involved in the real estate market. Also tips for first time home buyers. Any books or guides to read and questions. Im sure many people will be interested and it would be cool for everyone to see different views on the matters.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- 2,219

- 10

- Joined

- Apr 29, 2003

Bumping, Thread has potential. I'm interested too.

The more analysis you do, the better off you'll be.

Don't buy a home, just to buy a home. Yes, there's some benefit with the mortgage tax deduction (which, depending on the area you live and that cost) which may or may not trigger the threshold for you to itemize deductions (if not currently doing so already) which related more so to buying power.

However, certain areas the barriers to entry are higher than rental markets so doing breakeven analysis is key. Meaning, if things were to go to hell for you financially, are the costs you're putting into the home recouped through rental should you have to?

Knowing the county/state property tax laws so you can adequately plan.

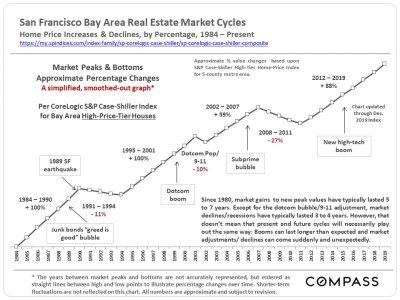

Hindsight is 20.20, I bought my first place in 2007....RIGHT as the !+!@ was starting. I should have backed out of the deal. Living w/ my parents after college I had saved something like 10% down and wanted to move out. My parents generation is one that thinks buying is great...well that may be true, but the dynamic of that has certainly changed for us.

Don't buy a home, just to buy a home. Yes, there's some benefit with the mortgage tax deduction (which, depending on the area you live and that cost) which may or may not trigger the threshold for you to itemize deductions (if not currently doing so already) which related more so to buying power.

However, certain areas the barriers to entry are higher than rental markets so doing breakeven analysis is key. Meaning, if things were to go to hell for you financially, are the costs you're putting into the home recouped through rental should you have to?

Knowing the county/state property tax laws so you can adequately plan.

Hindsight is 20.20, I bought my first place in 2007....RIGHT as the !+!@ was starting. I should have backed out of the deal. Living w/ my parents after college I had saved something like 10% down and wanted to move out. My parents generation is one that thinks buying is great...well that may be true, but the dynamic of that has certainly changed for us.

- 3,949

- 1,197

- Joined

- Nov 16, 2001

Most finance companies will encourage you to only put down what you need to (3.5% for FHA loans) to qualify for a home. It's best to buck that trend and get as close to the full 20% as possible to avoid PMI (private mortgage insurance) which is basically foreclosure insurance you're paying them in case YOU can't make the payment and foreclose.

ActiveRain.com is a great source of information from realtors and their experiences. A lot of the blogs will be insider stuff since they're mostly writing to other people in the industry, but there are also many blogs specifically written for a certain area and type of buyer.

You should also be aware that dollar for dollar, buying a home is nowhere near the same cost as renting. Even if you'll be paying the same or slightly less for a mortgage you should keep in mind that you'll have to do your own repairs, pay the property taxes, and do general maintenance on the property. If you think you'll be saving money over the first 10 years buying a home (even with the mortgage deduction), chances are you're not, until you are able to cash out the equity.

I'm in a similar boat to LazyJ10 except I bought the year after, RIGHT before the financial meltdown. Just remember that there's a home on every corner so don't let emotions get the best of you. There's not just one perfect home. If you're willing to sit back and be patient then a great deal will likely fall in your lap.

ActiveRain.com is a great source of information from realtors and their experiences. A lot of the blogs will be insider stuff since they're mostly writing to other people in the industry, but there are also many blogs specifically written for a certain area and type of buyer.

You should also be aware that dollar for dollar, buying a home is nowhere near the same cost as renting. Even if you'll be paying the same or slightly less for a mortgage you should keep in mind that you'll have to do your own repairs, pay the property taxes, and do general maintenance on the property. If you think you'll be saving money over the first 10 years buying a home (even with the mortgage deduction), chances are you're not, until you are able to cash out the equity.

I'm in a similar boat to LazyJ10 except I bought the year after, RIGHT before the financial meltdown. Just remember that there's a home on every corner so don't let emotions get the best of you. There's not just one perfect home. If you're willing to sit back and be patient then a great deal will likely fall in your lap.

- 500

- 228

- Joined

- Nov 29, 2002

I recently purchased my first home in April of 2011. Best decision of my life. Right now it is still a buyers market and you must always remember that. I truly got a STEAL on my house, and it was move in ready besides painting and a few sick replacements and upgrades. Many sellers are paying double mortgages due to them not being able to sell their homes, and are just looking to get rid of the house on the market.

My advice is to take your time, do not rush, and get exactly what you want and can afford. When it comes to a house its so many additional expenses you dont account for, so do not try and purchase something that you cant afford. Make sure you can pay the note, taxes, and utilities and still have some savings for unforseen occurences. Good luck though!

My advice is to take your time, do not rush, and get exactly what you want and can afford. When it comes to a house its so many additional expenses you dont account for, so do not try and purchase something that you cant afford. Make sure you can pay the note, taxes, and utilities and still have some savings for unforseen occurences. Good luck though!

tengoeljugode

Banned

- 292

- 48

- Joined

- Jul 7, 2012

Take it from someone who bought a short sale that needed a lot of work. BUY SOMETHING THAT IS MOVE-IN READY! Unless you have folks on folks on folks who know how to do renovations (luckily I did) you will be absolutely screwed.

My home purchase was part necessity (getting married) and part availability. I found a house for a very good price in a nice neighborhood and it had a front porch. The biggest selling point was that it backed to woods, a stream and a railroad track. I wanted to get sort of a secluded feel while still being right by a mall.

And the most important thing to understand about buying a house. Save 25% more money than you THINK you need. There are always expenses that pop up that you simply didn't plan for/ couldn't have foreseen. So if you need $20k for a down payment and closing costs or whatever, save around $25k before you pull the trigger.

If you need any specific pointers feel free to PM me.

My home purchase was part necessity (getting married) and part availability. I found a house for a very good price in a nice neighborhood and it had a front porch. The biggest selling point was that it backed to woods, a stream and a railroad track. I wanted to get sort of a secluded feel while still being right by a mall.

And the most important thing to understand about buying a house. Save 25% more money than you THINK you need. There are always expenses that pop up that you simply didn't plan for/ couldn't have foreseen. So if you need $20k for a down payment and closing costs or whatever, save around $25k before you pull the trigger.

If you need any specific pointers feel free to PM me.

- 2,825

- 206

- Joined

- May 20, 2008

if you live in the DMV check out www.270realestate.com I worked with one of the agents on this team and I was able to find a really good loan without paying the PMI. Also, I signed up for the listing book and I was able to query a search to find local homes for sale once it hit the market. Buying a home was the most stressful experience in my life but having a real estate agent that finds you the best loans and homes is what makes the process a tad bit less stressful

- 10,799

- 3,525

- Joined

- Sep 17, 2005

So if you need $20k for a down payment and closing costs or whatever, save around $25k before you pull the trigger.

QFT.

- 208

- 10

- Joined

- Aug 10, 2006

Bought my home almost a year ago. Learn from my mistake- shop LOCAL for your lender. I got lured into a great rate through lendingtree.com and the lender turned up being awful. My builder was getting so pissed about the delays (my home was a semi custom new construction) basically said if I wanted to keep the house I needed to find a different lender. Ended up closing 1 1/2 months late.

But having your own place?

Only other words of advice is think of where you see yourself 5 years from now. Truly think about it. Once you have a house its not like a lease, you can't just up and leave. I've turned down some job opportunities because I don't want to go through the hassle of selling and moving.

But having your own place?

Only other words of advice is think of where you see yourself 5 years from now. Truly think about it. Once you have a house its not like a lease, you can't just up and leave. I've turned down some job opportunities because I don't want to go through the hassle of selling and moving.

- 3,949

- 1,197

- Joined

- Nov 16, 2001

jschue wrote:

Only other words of advice is think of where you see yourself 5 years from now. Truly think about it. Once you have a house its not like a lease, you can't just up and leave. I've turned down some job opportunities because I don't want to go through the hassle of selling and moving.

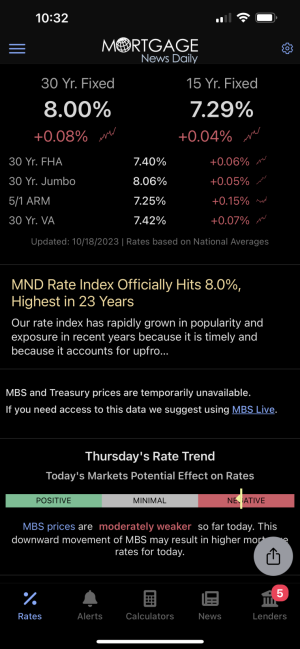

Very true! But on that same note, DO NOT get an adjustible rate loan. Even though they're slightly lower rates have NEVER been this low before. If you get a 5/1 ARM, you're 99% guaranteed that your payment will increase after 5 years (unless the economy continues on its current pace).

- 761

- 108

- Joined

- Jun 27, 2004

good thread

- 6,136

- 1,876

- Joined

- Feb 6, 2010

Any NTers bought a house recently? Im saving up like crazy and advice yall can share in the new market would be appreicated

hope to get this going again

hope to get this going again

- 428

- 185

- Joined

- Nov 16, 2007

Make shure your mortgage rate is fixed for the hole term of the loan. Get a home warranty it covers alot of the things that can fail in the house. Two years ago in the middle of summer our ac unit went out we called them they had someone there to fix it all we had to pay was 50.00.If it can't be fixed they pay to have what ever it is replaced

- 610

- 115

- Joined

- Jul 18, 2012

Any NTers bought a house recently? Im saving up like crazy and advice yall can share in the new market would be appreicated

hope to get this going again

Just closed on a house January 3rd.

Stack that paper son.

Live below your means to be on the safe side.

Get a Fixed rate.

Have 2-3 months of mortgage payments saved.

Get those monthly bills situated.

Get that credit score up.

Pay off any debt.

No more $150 kicks. You have more important things to worry about.

- 18,297

- 1,007

- Joined

- Apr 1, 2009

Anyone know if it'll be really expensive to remove popcorn ceiling? In the process of renovating a rental my parents own that will be mine if I can find a job here.

paulprince3730

Banned

- 4,948

- 1,056

- Joined

- May 23, 2013

nah man, i wanna know the best way to go about acquiring capital and what kind of capital should i be throwin around to make some money flippin

yes i know its a buyers market right now

yes i know its a buyers market right now

- 15,107

- 15,687

- Joined

- Nov 2, 2006

In for the thread equity

paulprince3730

Banned

- 4,948

- 1,056

- Joined

- May 23, 2013

have thatIn for the thread equity

- 30,634

- 10,381

- Joined

- May 22, 2009

All I can say is down 20% and avoid the PMI

And get a fixed rate.

And get a fixed rate.

Last edited:

- 2,660

- 738

- Joined

- Jan 13, 2004

Any NTers bought a house recently? Im saving up like crazy and advice yall can share in the new market would be appreicated

hope to get this going again

Bought a condo in October. You will encounter things you didn't know needed repair, so just keep that in mind.

Honestly, I wouldn't dump all my money into my place, as is the typical American strategy. In fact, it's my 4th or 5th largest investment. There are A LOT better returns on capital that owning a place, but with interest rates so low, it almost seems not to take advantage of this cheap money.

See a ton of places, do research on not just the city/neighborhood, but YOUR BLOCK. Also, if you can, find a friend who is a real estate agent and tell them to throw you some cash back.

- 570

- 191

- Joined

- Jun 1, 2008

Is it possible to get a home with no down payment what so ever and a loan but good credit for a home in the $300k range?

- 14,952

- 4,207

- Joined

- May 26, 2003

Is it possible to get a home with no down payment what so ever and a loan but good credit for a home in the $300k range?

if your a first time buyer depending on your city and income there are downpayment assistance programs.

- 170

- 38

- Joined

- Jul 20, 2012

Save at least 3-6 percent of the home you want. Make sure your cc are payed down. A steady job atleast 1 year and 650

- 1,048

- 62

- Joined

- Feb 17, 2008

Looking to get a crib soon. I have money saved but i gotta get my credit score up smh. Buying a house is hard work.

- 9,092

- 7,285

- Joined

- Aug 30, 2008

jschue wrote:

Only other words of advice is think of where you see yourself 5 years from now. Truly think about it. Once you have a house its not like a lease, you can't just up and leave. I've turned down some job opportunities because I don't want to go through the hassle of selling and moving.

In regards to the whole 5 year thing..wouldnt you just be able to rent it out? and make more income?