- 4,410

- 1,807

- Joined

- Jul 19, 2012

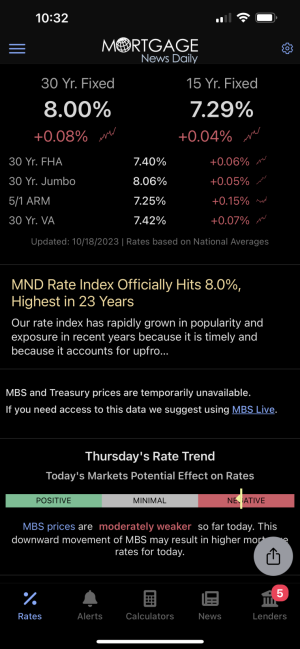

Is that because different lenders for different things (credit card, automotive, mortgage,etc.) use different versions/editions of the FICO and there's a specific score for mortgage, credit cards,etc. specifically? Or is it just different companies uses different models?@dontbelikethat Just to let you know that discover FICO score is not used in mortgage lending. My mortgage score is 30 points lower than my credit card score.

That latter was my understanding going through this thread and some others, but it was a while ago so my memory is a little hazy...

http://ficoforums.myfico.com/t5/Und...Editions-versions-and-variations/td-p/1197617

For ex. Discover Card FICO uses the TU 08 model, then from what what I remember, I think I saw somewhere that a company like Nissan uses like the Experian 04 model for their automotive financing. So the difference in bureau's & models each bureau uses can cause the variation in scores?

Last edited: