antidope

Supporter

- 62,481

- 65,410

- Joined

- Jan 2, 2012

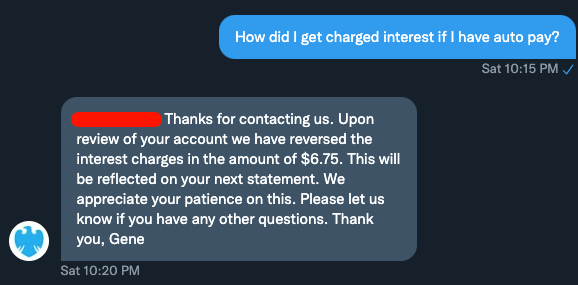

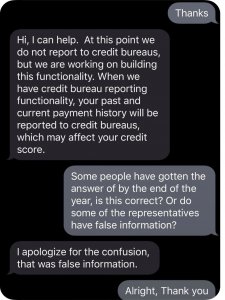

I just called them, they said if I dont pay the balance in full by the statement date they're charging interest.

The statement cycle ends with the date that it shows on your March statement. Anything after that is included for the next cycle and you'll have to pay interest on any new charges since the end of that last statement you received. So, yes. You'll pay interest. The only way you pay it in full going off the statement is if you haven't used your card since that statement cycle ended.

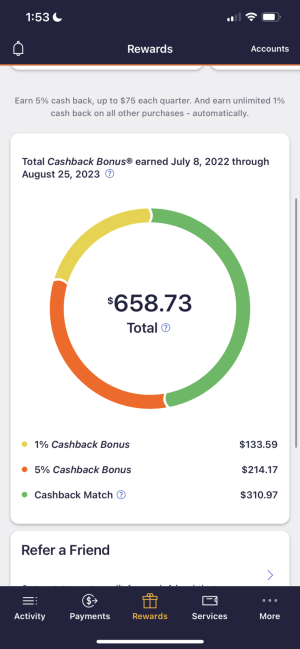

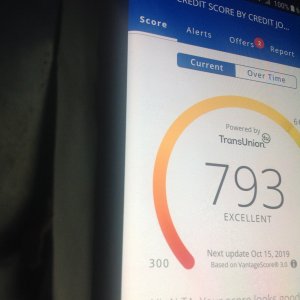

I really hate this card, that was really the decision to get a legitimate credit card and get off this store credit card from the Gap. Applying for Chase Freedom today.

Got approved 5k limit. I'll never use that much but I'm glad to have it.

Last edited:

.

.