- 14,173

- 6,430

- Joined

- Feb 4, 2012

I understand how using a credit card works.. My question to you guys is it like the more you spend with your credit card the higher your credit score will be? Or that doesn't matter? And this is assuming I'm paying my bill in full on time.

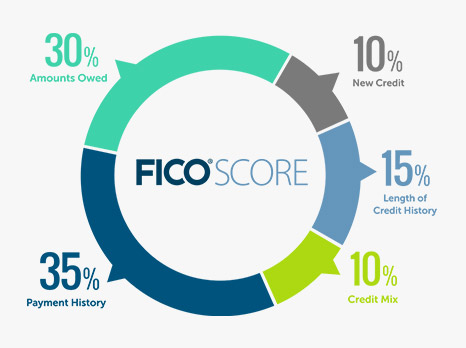

your credit bureau is based on Credit History / Credit availabitlity / Credit use among other variables.

It's good to have a long good credit history (paying everything on time, not having any bills in collection, etc.).

It's also good to have credit available (If i can show i can manage a 10k credit card without blowing it all up at the casino, it's good. It means i'm responsible with my credit).

It's good too if you use a low % of your credit available (like said earlier, under 30% is important for your credit score to rise through time). It also shows that your are responsible. If you use a high % of your credit and make all your payments, your score will rise, but slower than someone with a low % of credit use vs credit available.

It's very important to not have any bad notes on your credit bureau. That's why it can be important to check it up and see wha't on there. It can happen that something what put into collection, but had nothing to do there and it tarnishes your score. You can get it removed if you contest it properly.

Last edited:

. At least I didn't get denied immediately but still.

. At least I didn't get denied immediately but still.