- 8,066

- 3,487

- Joined

- Dec 14, 2003

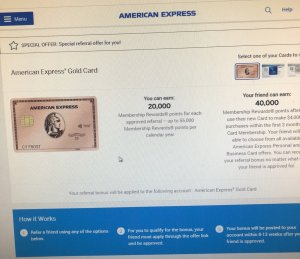

Like I said earlier, Amex Platinum is only worth it if you travel a lot and spend a ton of money on the card.

If you're into gas and groceries, then you should look into Blue Cash Preferred.

I do travel a lot

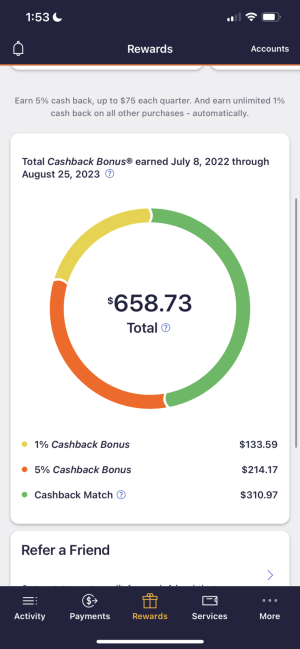

That's why i have the AMEX gold 4x Points on flight purchases....I don't really mess with Cash Back cards.

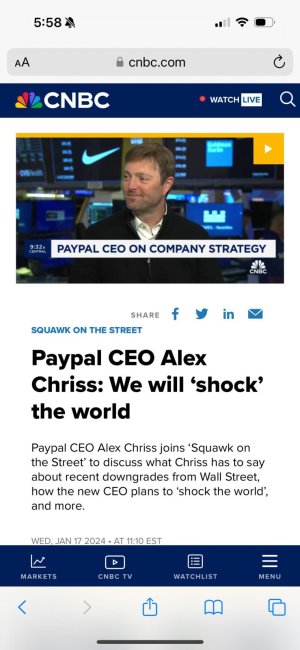

also Chase is killing AMEX right now.

AMEX is going to have to step it up next year if they want to keep me.

Last edited:

I suppose those are all legitimate reasons to keep the card.

I suppose those are all legitimate reasons to keep the card.  good one

good one  10% cashback on Nike.com sometimes they do 15%

10% cashback on Nike.com sometimes they do 15%