- 1,784

- 355

- Joined

- May 14, 2001

Trading today was ehh. Second guessed myself on a couple shorts and missed solid trades early on. Ended up taking a few small losing trades and ended up red on the day. Lesson act without over thinking.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

oil going parabolic so I'm taking small profits here on the USO calls and will readd on the dip. .767 average for entry, 1 exit. modest gain on a 4 lot.

opinions on AAPL upcoming earnings? i own some $115 Feb Calls, getting a bit nervous

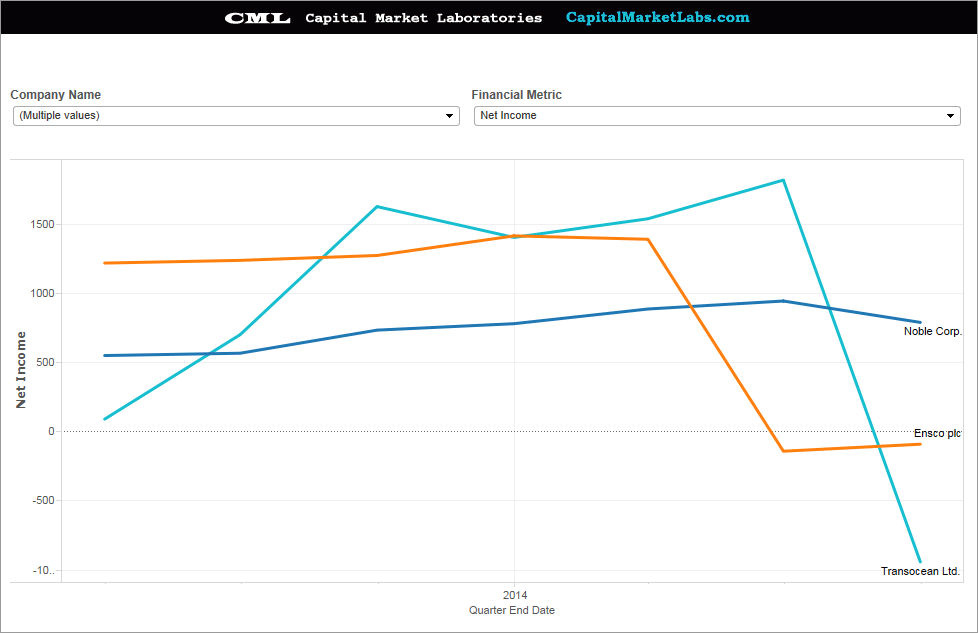

These graphs show why I actually like XOM off dips as oil crashes. No position though.

I am caught short in the FXCM halt 1.45 average, 500 shares. Time will tell

Not looking good ugh

loving the swiss move. let the slaughtering continue

Yea ate about 1500 bucks on that smh

...

...