- 4,758

- 1,409

- Joined

- Nov 6, 2012

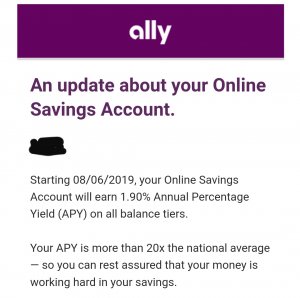

Do guys know if Barclays allows you to open multiple or sub accounts? I'd like to have everything in one place but have multiple accounts for emergency, wedding, etc. I believe Ally does but I was interested in Barclays online savings and dream account.

Thanks.

Yes Barclays allows you to open multiple accounts