- 2,325

- 269

- Joined

- May 31, 2011

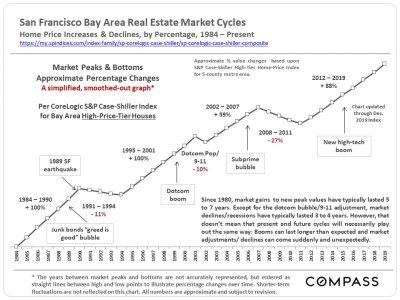

What would happen if student loans crash?

People will then default on their other credit lines. People are so heavily in debt in this current economy. It's only a matter of time till all the debt dominos fall. Time to invest in cash

i kid

i kid