- 70,049

- 24,221

- Joined

- Aug 1, 2004

BECOME DEBT-FREE

Millennials have an average of $28,000 in debt—and the biggest source isn’t student loans

Published Wed, Sep 18 2019 11:13 AM EDT

Megan Leonhardt@MEGAN_LEONHARDT

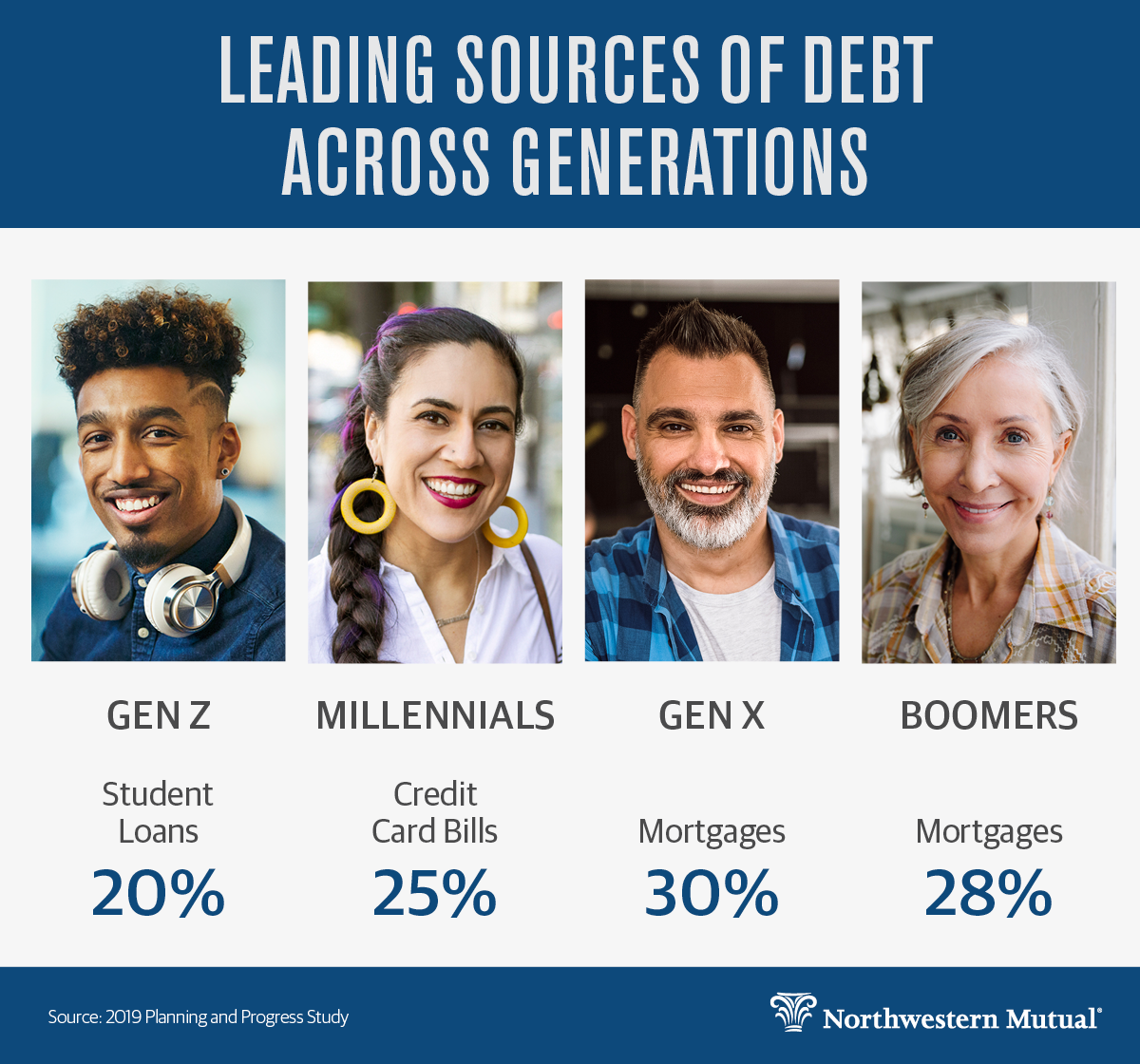

Northwestern Mutual’s 2019 Planning & Progress Study. The findings are based on a survey conducted by The Harris Poll of over 2,000 U.S. adults.

The biggest source of debt? Credit card bills. And that’s a “troubling” trend, Chantel Bonneau, a financial advisor with Northwestern Mutual, tells CNBC Make It.

“One issue that a lot of millennials have is that they have not wanted to sacrifice their lifestyle, even though they have student loans or lower incomes,” Bonneau says. “That has left us in this spot where they’ve accumulated a significant amount of credit card debt.”

That’s especially concerning because it’s important to save for future financial goals, such as buying a home or building a retirement fund, when you’re young and have time to let compound interest grow your money.

But because millennials are balancing both student loans and credit card debt, “the likelihood that millennials are prioritizing retirement in any meaningful way as an overall generation seems unlikely,” Bonneau says.

Yet for many millennials, the slide into debt goes beyond just lifestyle creep. Wages are not keeping up as day-to-day costs continue to soar, according to Alissa Quart, executive director of the Economic Hardship Reporting Project and author of “Squeezed: Why Our Families Can’t Afford America.”

The average paycheck only has the same purchasing power it did 40 years ago, a Pew Research report found. Almost two-thirds of millennials say they’re living paycheck to paycheck and only 38% feel financially stable, according to Schwab’s 2019 Modern Wealth report.

Student loans are also a factor. The number of households with student loan debt doubled from 1998 to 2016, Pew Research Center found. The median amount of loan debt millennials carried was $19,000, significantly higher than Gen Xers’ balance of $12,800 at the same age.

While it may be easy to criticize millennials for simply spending too much, it’s important to remember that there are other issues at play, Terri Kallsen, Schwab’s executive vice president of investor services, tells CNBC Make It. “Spending is not the enemy that we might think that it is,” she says

https://www.cnbc.com/2019/09/18/student-loans-are-not-the-no-1-source-of-millennial-debt.html

Millennials have an average of $28,000 in debt—and the biggest source isn’t student loans

Published Wed, Sep 18 2019 11:13 AM EDT

Megan Leonhardt@MEGAN_LEONHARDT

Northwestern Mutual’s 2019 Planning & Progress Study. The findings are based on a survey conducted by The Harris Poll of over 2,000 U.S. adults.

The biggest source of debt? Credit card bills. And that’s a “troubling” trend, Chantel Bonneau, a financial advisor with Northwestern Mutual, tells CNBC Make It.

“One issue that a lot of millennials have is that they have not wanted to sacrifice their lifestyle, even though they have student loans or lower incomes,” Bonneau says. “That has left us in this spot where they’ve accumulated a significant amount of credit card debt.”

That’s especially concerning because it’s important to save for future financial goals, such as buying a home or building a retirement fund, when you’re young and have time to let compound interest grow your money.

But because millennials are balancing both student loans and credit card debt, “the likelihood that millennials are prioritizing retirement in any meaningful way as an overall generation seems unlikely,” Bonneau says.

Yet for many millennials, the slide into debt goes beyond just lifestyle creep. Wages are not keeping up as day-to-day costs continue to soar, according to Alissa Quart, executive director of the Economic Hardship Reporting Project and author of “Squeezed: Why Our Families Can’t Afford America.”

The average paycheck only has the same purchasing power it did 40 years ago, a Pew Research report found. Almost two-thirds of millennials say they’re living paycheck to paycheck and only 38% feel financially stable, according to Schwab’s 2019 Modern Wealth report.

Student loans are also a factor. The number of households with student loan debt doubled from 1998 to 2016, Pew Research Center found. The median amount of loan debt millennials carried was $19,000, significantly higher than Gen Xers’ balance of $12,800 at the same age.

While it may be easy to criticize millennials for simply spending too much, it’s important to remember that there are other issues at play, Terri Kallsen, Schwab’s executive vice president of investor services, tells CNBC Make It. “Spending is not the enemy that we might think that it is,” she says

https://www.cnbc.com/2019/09/18/student-loans-are-not-the-no-1-source-of-millennial-debt.html