RustyShackleford

Supporter

- 62,894

- 188,850

- Joined

- Jul 20, 2009

I know you don't mean any malice behind it but mods already warned us not to make any jokes about Pete's name than evolve butt or booty or anything like that because it is in poor taste given he is gay.https://www.nytimes.com/2019/04/22/us/politics/cnn-town-hall-highlights.html

Ok found it and yeah Harris said she would use executive order to enforce gun checks, Klobuchar embarrassed herself by pulling a Jeb, Bernie said something controversial, BAE Warren killed it, and Booty had to answer why he fired a police chief for investigating racism.

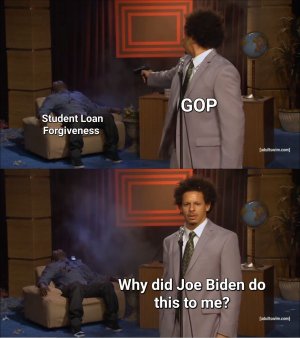

Warrens loan forgiveness was a issue brought up. She is changing the conversation.