RustyShackleford

Supporter

- 63,001

- 189,135

- Joined

- Jul 20, 2009

-Thanks I will check it out later.@gry60 andRustyShackleford you guys touch on the exact reason why trickle down economics don’t work, and why it’s more effective to empower the bottom 90% as opposed to the top 10% if your true goal is sustained economic growth. The vast majority of consumers are the 90%, and are far more reliant in consuming goods than the 10%.

This paper is pretty technical but it does a good of what happens during times when the bottom 90% of earners experiences tax relief vs the top 10%.

The conclusion of the paper summarizes the point well.

“This paper quantifies the importance of the distribution of tax changes for their overall impact on economic activity. I construct a new data series of tax changes by income group from tax return data. I use this series and variation from the income distribution across states and federal tax shocks to estimate the effects of tax changes for different groups. I find that the stimulative effects of income tax cuts are largely driven by tax cuts for the bottom 90% and that the empirical link between employment growth and tax changes for the top 10% is weak to negligible over a business cycle frequency. These effects are not confounded by changes in progressive spending, state trends, or prior economic conditions. The effects seem to come from labor supply responses as well as increased consumption and investment.

These results are important for characterizing central equity-efficiency tradeoffs in tax policy. If policy makers aim to increase economic activity in the short to medium run, this paper strongly suggests that tax cuts for top-income earners will be less effective than tax cuts for

lower-income earners. While it is possible that tax cuts for top-income earners have sizable long-run impacts through different channels such as human capital investment, firm creation, or innovation,much more compelling evidence on these channels is needed to support top- income tax cuts on efficiency grounds, especially given the magnitude of resources devoted to these tax policy changes. Overall, the results not only suggest some skepticism for “trickle down” economics, but they also provide evidence that supply-side tax policies should do more to consider the relative efficacy of tax cuts targeted lower in the income distribution. Finally, as a note of caution, the estimates in this paper come from modest changes in tax rates that have been executed in the post-war period; using these estimates to evaluate the likely impacts of large tax changes on high-income earners requires extrapolation beyond the observed variation in the data.”

https://www.nber.org/papers/w21035.pdf

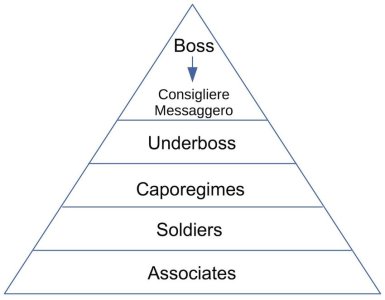

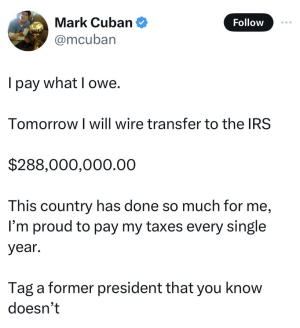

-When trickle down economics was first pitched, some wanted to pitch it as a demand side plan.

In that if we cut the taxes of the rich they would go on spending binges and buy up so many goods and services it would stimulate the economy. The would buy two more cars, yachts, hire nannies, cooks, and gardeners, they would get out more and have more money to put toward charities.

The argument was view as so ridiculous it never gained traction. Instead it was a better play to paint the rich as altruistic job creators that would surely do right by the common man and share in the economic prosperity if they were free from the oppression of high taxation.

The fact so many people still beleive this nonsense proves trickle down economics is one of the greatest scams ever ran.

Last edited: