- 17,658

- 7,943

- Joined

- Jul 7, 2005

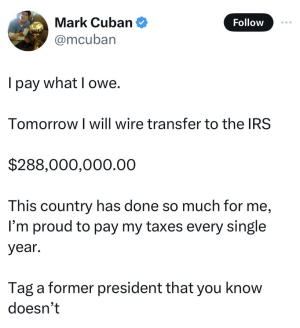

Sigh

If I was worried about being accepted, in this thread, I’d just bash Trump all day. It isn’t a difficult concept; I’m fully aware of the path of least resistance.

I re-posted an article from Billboard. I didn’t write it. And I offered it without commentary. If you have an issue with it, take it up with Billboard—not me.

As always, it is refreshing to hear from you (the voice of black people) on how I need to think to be black. That type of stuff might work with other folks vying for your approval, but not with me.

‘06 anyway good bruh.

My overall point in my response to you is to simply say.......never turn your back on your people cause your people will eventually turn their collective backs on you. It’s not necessarily about all of us always being in constant agreeance with one another about everything, as that would be absurd. With you however you have shown a pattern that is detrimental.

‘06 to you good bruh.