- 2,328

- 2,078

- Joined

- Oct 16, 2010

What are you fees? How can I sign up?

Congrats!! You're having a banner Q!

thanks man, best of my life so far.

thanks man, best of my life so far.Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

What are you fees? How can I sign up?

Congrats!! You're having a banner Q!

thanks man, best of my life so far.

thanks man, best of my life so far.JNUG has been a gold mine this month

No pun intended I’m glad I took advise and bought actual shares instead of options

kicking myself for not doing this when it was at 70

too late now

Been sitting on it for about 2 years now, not making much noise. It is just their, I pay it no mind at this point.Man, my dumba** got caught holding NVDA. Kinda want to take the L and just claim it on my taxes for next year, so I can at least free up some money for other trades.

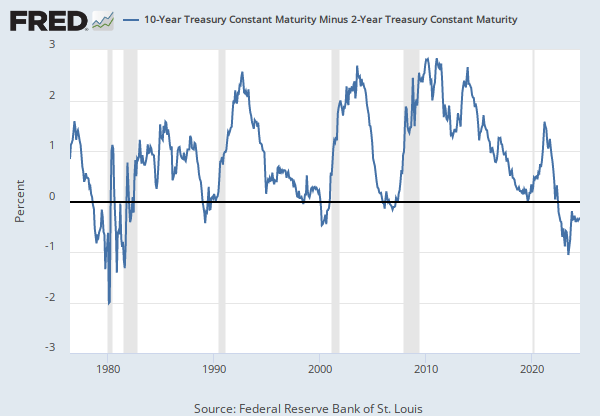

Yup, rising unemployment will be the final trigger, still not there yet but we already have had negative revisions to the jobs number for the past 3 months in a row, which is a bad sign.

http://www.mediafire.com/file/5py1d1zrii5rr1a/The_Recession_Playbook.pdf/file

This is by Morgan Stanley, some interesting charts to look at. I'm getting more and more bearish about this market, I don't think rate cuts and QE will do anything to stop the decline.

I’d prefer not to open a new position in favor of adding to current positions, but the insider buying at ABBV is temping to piggy-back on. Could be a quick 25% return in a few months.

tkthafm what's that usually mean in laymen's terms? Not familiar with what that usually indicates.