- 4,159

- 3,902

- Joined

- Jul 20, 2012

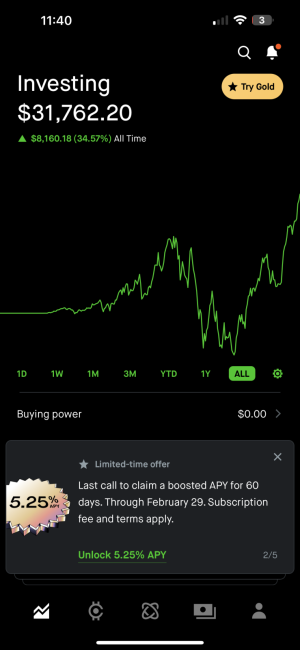

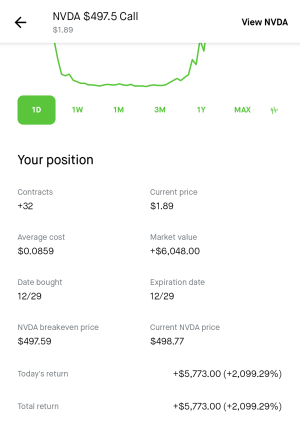

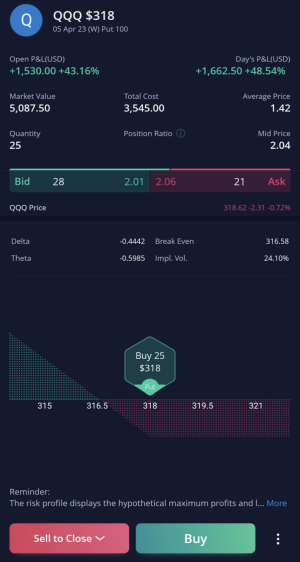

Ameritrade was like

Nah we ain’t changing the option contracts rates

So it’s back on tastyworks until I hit 25k

Nah we ain’t changing the option contracts rates

So it’s back on tastyworks until I hit 25k

Maybe one day if I actually trade more I'll look elsewhere for options trading.

Maybe one day if I actually trade more I'll look elsewhere for options trading.