- 4,222

- 1,903

- Joined

- Aug 26, 2009

Thanks for the link! I read a TL;DR from someone else. Going to delve into this this weekend.always do DD and trust no one. whatever someone says is just a starting point for your own personal journey.

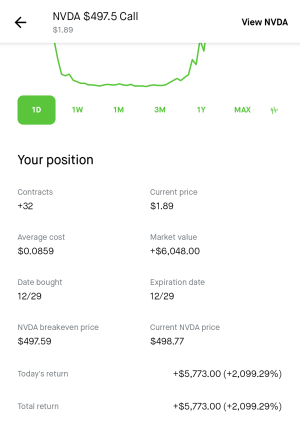

they probably have something in their TOS that prevents them from being liable. it is dirty that they did that. but Wall Street is a dirty game to begin with. this will hurt their IPO tho. CashApp should get more attention from this, Jack needs to add options trading and charting to the app.

Btw now that the bs is done, please read Ark's big ideas for 2021

this is fantastic info, im going to synthesize when im done reading and think about which stocks fit each theme.

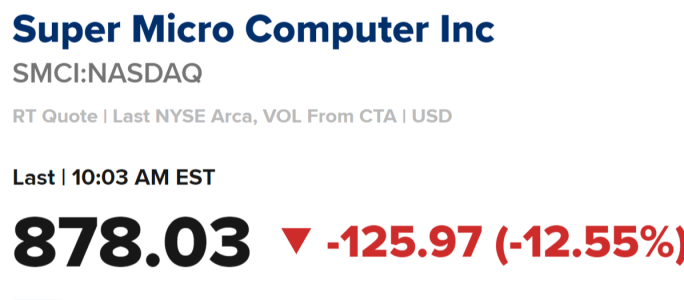

. Everyone saw the crash coming, but to say retail wasn’t a major part in this when they basically shut down retail investors from trading the stock is crazy to me.

. Everyone saw the crash coming, but to say retail wasn’t a major part in this when they basically shut down retail investors from trading the stock is crazy to me.