- 13,917

- 5,869

- Joined

- Sep 28, 2004

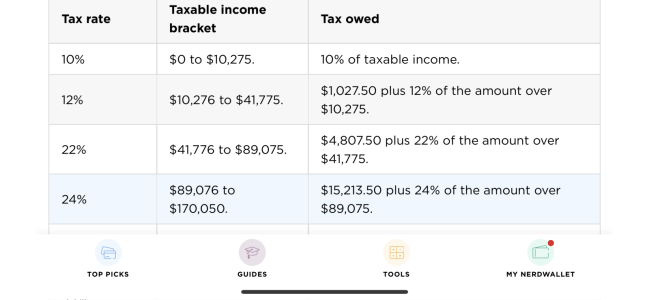

The 0-1-2-3 type system has been gone a year or two now. It’s much harder imho but some get grandfathered in. It’s now a a so called simpler system. If multiple w2s mess things up for you, try to do the additional withholding and be safe about it I presume. All else equal, get a taxcaster type app and know what you should be owing at years end and adjust in September or October.Royally messed up on my W4 when i started my job in April 2021, didn’t catch the mistake until now … luckily i can cover the difference but ouch

Usually basic w4s assume that it’s your only job, so they usually take out more than needed. One usually needs to adjust the other way. Best of luck.