- 37,632

- 51,666

- Joined

- Feb 2, 2014

What do you mean "upside down" in my current house?A lot of great points in here that IMO start to tell the whole story.

I lived the terrible market when I bought my house last year. We put in 9 bids before one hit. The townhouse we landed we don't even like and we paid well above my rational market value. We were outbid on all our other bids by 10-80k. Our first bid was in January and the final one we hit on was April. We were out every single weekend looking at houses and needed to have our offers in the day the house went up or it would be gone. These investment firms were waiving inspections, cash offers and buying homes sight unseen. And here i am walking around houses asking about the HVAC and Roof age..... *puts on clown makeup*

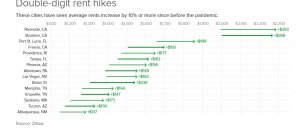

All this to say we were priced out of our DC rental when the land lord wanted us to pay $3,100 for our 900sq foot place. I had some money saved for a down payment and I couldn't fathom paying that much in rent when my job was leaning toward remote at the time. I fully expect all of this to come crashing down knowing I will probably be upside down in my current house.

I feel you and I were in very similar situations with being new parents and looking for a house. I actually went a different route and didn't buy a house in this current market cause I knew we would be paying for a home that we didn't necessarily like but felt pressured by the circumstances.

Now we are just waiting it out hopefully for some normalcy in the housing market.