- 1,959

- 286

- Joined

- Mar 13, 2013

Instead of us getting taxed on $20,000 AND 200 + transactions .. we'll get taxed when we sell more than $600 on goods starting in 2022

www.twrblog.com

www.twrblog.com

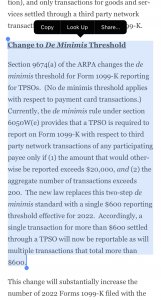

American Rescue Plan Act Clarifies Scope of Form 1099-K Reporting and Reduces De Minimis Threshold

On March 11, 2021, President Biden signed the American Rescue Plan Act of 2021 (the “ARPA”) into law. The ARPA includes clarifying language regarding the