cj863

Banned

- 4,888

- 496

- Joined

- Jun 4, 2008

aside from medicare and it's primarily the practitioners doing it.

Sigh guess I'll quote myself again...

Last edited:

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

aside from medicare and it's primarily the practitioners doing it.

draconian tax hikes

[COLOR=#red]Study: Tax Cuts for the Rich Don't Spur Growth[/COLOR]

Cutting taxes for the wealthy does not generate faster economic growth, according to a new report. But those cuts may widen the income gap between the rich and the rest, according to a new report.

[COLOR=#red]A study from the Congressional Research Service -- the non-partisan research office for Congress -- shows that "there is little evidence over the past 65 years that tax cuts for the highest earners are associated with savings, investment or productivity growth."

In fact, the study found that higher tax rates for the wealthy are statistically associated with higher levels of growth.[/COLOR]

The finding is likely to fuel to the already bitter political fight over taxing the rich, with President Obama and the Democrats calling for higher taxes on the wealthy to reduce the deficit and fund spending. Mitt Romney and the GOP advocate lower marginal tax rates for top earners, saying they fuel investment and job creation.

The CRS study looked at tax rates and economic growth since 1945. The top tax rate in 1945 was above 90 percent, and fell to 70 percent in the 1960s and to a low of 28 percent in 1986.

The top current rate is 35 percent. The tax rate for capital gains was 25 percent in the 1940s and 1950s, then went up to 35 percent in the 1970s, before coming down to 15 percent today - the lowest rate in more than 65 years.

Lowering these rates for the wealthy, the study found, isn't aligned with significant improvement in any of the areas it examined. Pushing tax rates down had a "negligible effect" on private saving, and while it does note a relationship between investing and capital gains rates, the correlations "are not statistically significant," the study says.

"Top tax rates," it concludes, "do not necessarily have a demonstrably significant relationship with investment."

The study said that lower marginal rates have a "slight positive effect" on productivity while lower capital gains rates have a "slight negative association" with productivity. But, again, neither effect was considered statistically significant.

Do higher taxes on the rich lead to faster economic growth? Not necessarily. The paper says that while growth accelerated with higher taxes on the rich, the relationship is "not strong" and may be "coincidental," since broader economic factors may be responsible for that growth.

There is one part of the economy, however, that is changed by tax cuts for the rich: inequality. The study says that the biggest change in the distribution of U.S. income has been with the top 0.1 percent of earners - not the one percent.

The share of total income going to the top 0.1 percent hovered around 4 percent during the 1950s, 1960s and 1970s, then rose to 12 percent by the mid-2000s. During this period, the average tax rate paid by the 0.1 percent fell from more than 40 percent to below 25 percent.

The study said that "as top tax rates are reduced, the share of income accruing to the top of the income distribution increases" and that "these relationships are statistically significant."

In other words, cutting taxes on the rich may not grow the economic pie. But the study found that those cuts can effect "how that economic pie is sliced."

http://finance.yahoo.com/news/tax-cuts-rich-dont-spur-151649273.html

[COLOR=#red]Economist Stands By Tax Cut Study After GOP Successfully Demands Its Withdrawal[/COLOR]

The author of a Congressional Research Service study, who found no evidence that tax cuts for high income earners lead to economic growth, is standing by his work, after the legislative branch’s nonpartisan research arm withdrew the report under pressure from Republican leaders. And Democratic principals are demanding to know why CRS caved to GOP pressure.

CRS quietly and quickly pulled the six-week old report, despite the wishes of the research arm’s economic team, the New York Times reported Thursday.

“I wasn’t involved in the decision, as a matter of fact I was on vacation when the decision was made, so I can’t really add anything to what was reported in the NY Times,” Thomas Hungerford, the author of the study, told TPM in an email Thursday afternoon. “However, I certainly stand behind my work.”

Rep. Sander Levin (D-MI) — the top tax writing Democrat in the House — wants CRS to answer for its decision.

“I was deeply disturbed to hear that Mr. Hungerford’s report was taken down in response to political pressure from Congressional Republicans who had ideological objections to the report’s factual findings and conclusion,” Levin wrote in a letter (PDF) to CRS Director Mary Mazanec. “It would be completely inappropriate for CRS to censor one of its analysts simply because participants in the political process found his or her conclusion in conflict with their partisan position. I would like your explanation as to why this report was removed from the CRS website, who made that decision and what considerations led to it.”...

http://tpmdc.talkingpointsmemo.com/2012/11/crs-withdraws-study-taxes-growth-mcconnell-hatch.php

[/COLOR]

[/COLOR][COLOR=#red]Petraeus was banging a chick named Paula Broadwell, who was writing his biography with the title "All In" ...how appropriate[/COLOR]

yup. the only way she could write the final chapter was for her to get that work

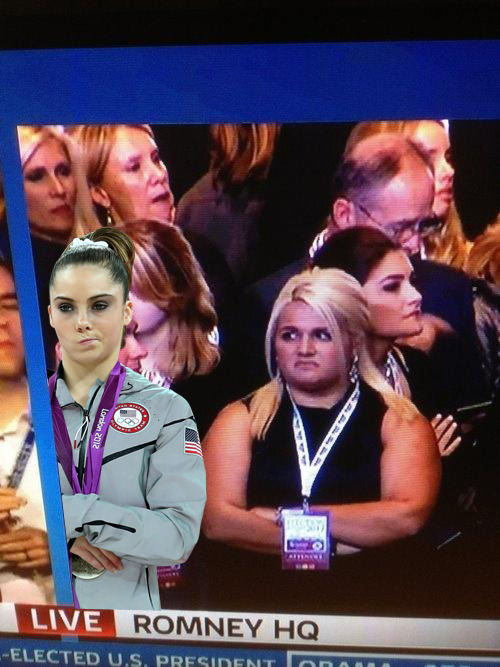

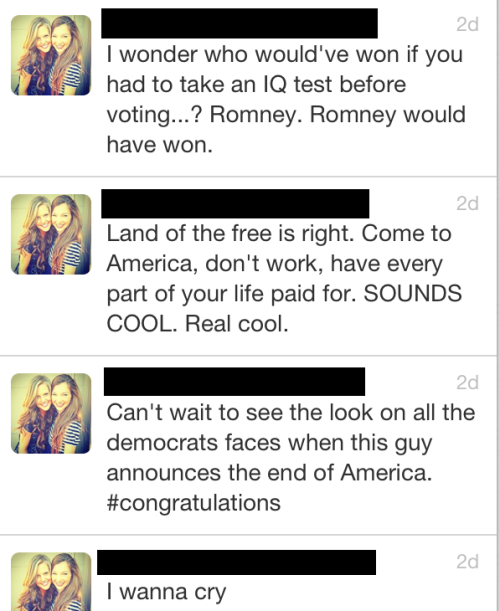

Dumb blondes.It would be easier to hate Romney supporters if only their young women weren't so hot

of course its been posted

of course its been posted

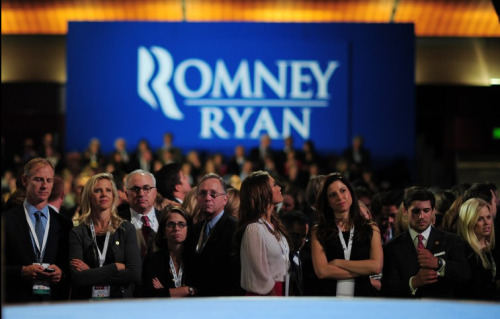

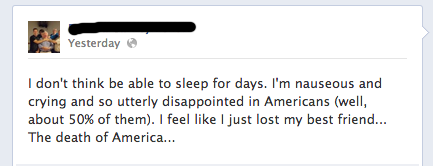

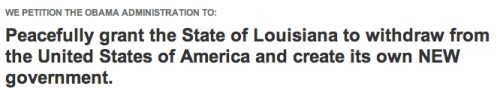

Look at the HURT on those people's faces, man.You'd think they were told they gotta suck a ***** **** for some Trukfit to continue living.

for real. And I bet some are NTers

for real. And I bet some are NTers

your first rodeo? yea, supporters of the loser always look like that.Look at the HURT on those people's faces, man.

Seriously, like dude tries to behave like a conservative, but doesn't even properly represent their message or their Image(is their a DR equalivalant to Uncle Tom?)this is why im a fan of da fiscal cliff, if they dont get their act together then everyone is gonna feel da pain equally[/S].

Shut up. All you do is spew bs conservative rhetoric then try and rerock it like it's a different product. Fraud is virtually nonexistent aside from medicare and it's primarily the practitioners doing it. Do yourself a favor and stop spitting that tired fox news bs over and over.

Absolutely one of the most comforting posts I've ever witnessed on Nike Talk, since my many years of visiting here.Another round of tears...

Are OptimusPrime?Absolutely one of the most comforting posts I've ever witnessed on Nike Talk, since my many years of visiting here.

Thanks, it's greatly appreciated.

[COLOR=#red]Petraeus was banging a chick named Paula Broadwell, who was writing his biography with the title "All In" ...how appropriate[/COLOR]

[COLOR=#red]The FBI was investigating it the whole time. Now please stop with the conspiracy rumors.[/COLOR]

Those are a lot of pictures of various venues. To not come across a single non-white face is telling.

And I'd love to see hood in a champion hoodie and some foams at the front of one of those conservative rallies.