- 4,311

- 10,471

- Joined

- Jun 27, 2007

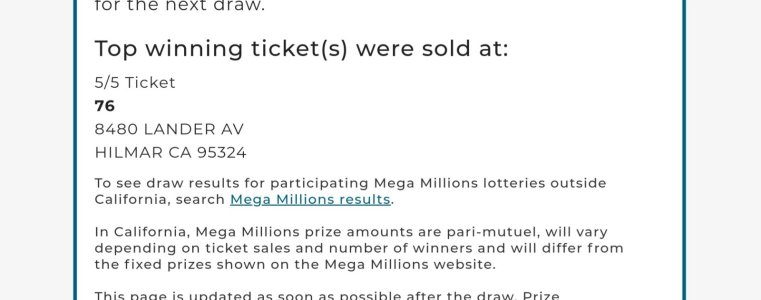

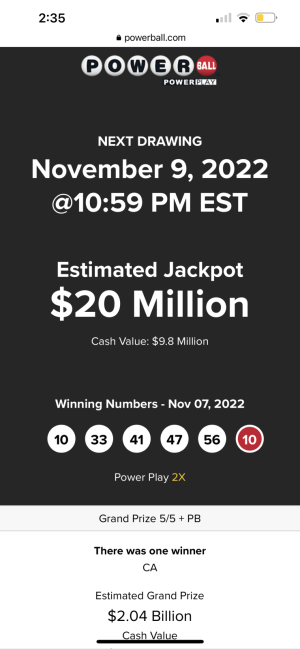

Jackpot has rolled over again to $284,000,000.

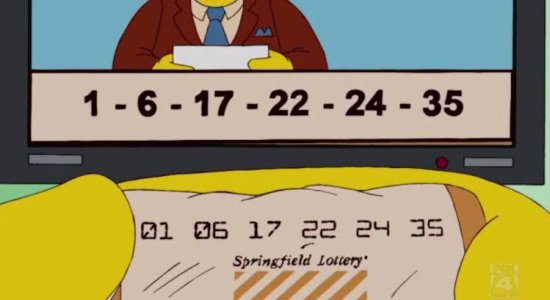

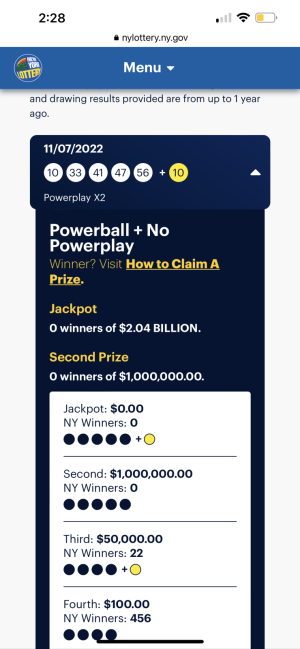

I think i matched the 1st 3 numbers like twice. I've gotten the power/ mega ball number countless of times.

What's the closest y'all ever got? A few jackpots ago I got the powerball and two numbers right. The last three white balls I was in the ballpark, like I was just 1-3 numbers off on each one.

Damn near went into cardiac arrest.

It def hurts a lot more when you're that close. It's whatever when you're way off but when you're just a couple digits off like that man....

Feelsbatman....

I think i matched the 1st 3 numbers like twice. I've gotten the power/ mega ball number countless of times.