- 305

- 226

- Joined

- Sep 3, 2015

Supreme game is a lot like the shoe game nowadays, though: saturated. People buy basically EVERYTHING up with the hopes of it being hyped, and then end up selling a good bit of it for retail or less a month or two later.

There are a good percentage of the items you can make a small profit on, like less than $50. Those are kinda like Jordans nowadays; the only way you will make any decent money with those is selling in bulk.

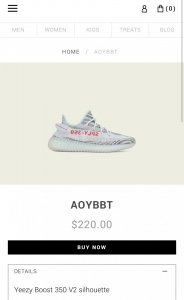

Of course you have your guaranteed hype moneymakers like TNF, box logo's, etc, but, much like Yeezy's, those aren't coming out every week.

Since I guess my question from earlier has somehow steered the conversation towards Supreme, does anyone who knows about the brand think the trades I was talking about earlier are about in the same ballpark, value-wise?

There are a good percentage of the items you can make a small profit on, like less than $50. Those are kinda like Jordans nowadays; the only way you will make any decent money with those is selling in bulk.

Of course you have your guaranteed hype moneymakers like TNF, box logo's, etc, but, much like Yeezy's, those aren't coming out every week.

Since I guess my question from earlier has somehow steered the conversation towards Supreme, does anyone who knows about the brand think the trades I was talking about earlier are about in the same ballpark, value-wise?