- 3,667

- 2,457

- Joined

- Feb 29, 2008

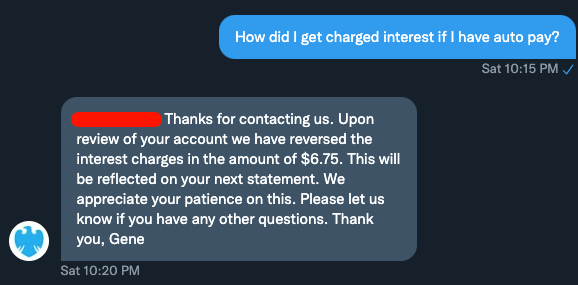

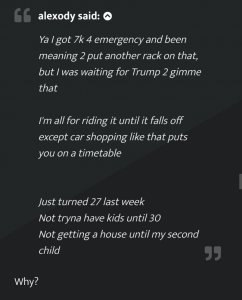

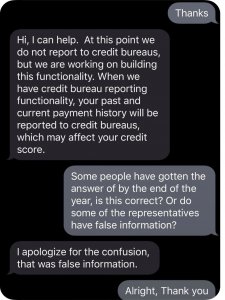

that post was the definition of not reading the post you're quoting

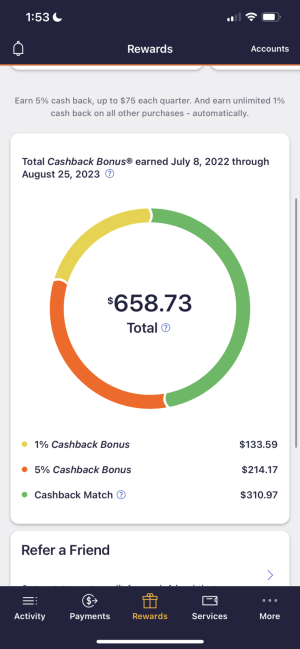

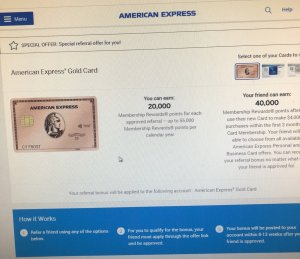

To answer your question, I'd go ahead and assume no just cause I would assume that the CC companies are smart enough to not allow it.

Right?

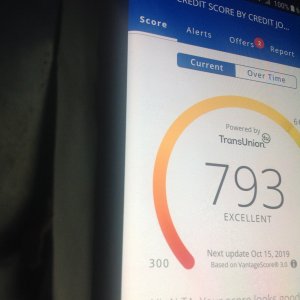

But preesh yea I was thinking that cause that would be too easy lol. Wanted to make sure in case I was missing out on a couple extra dollars a month