- 3,949

- 1,197

- Joined

- Nov 16, 2001

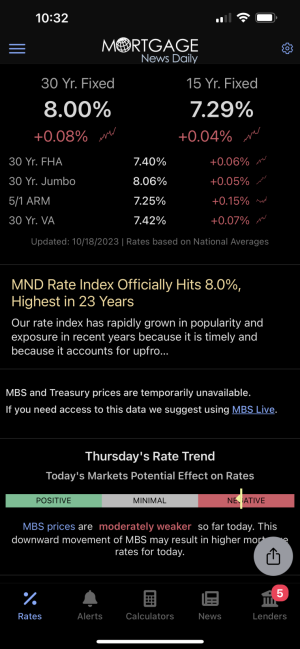

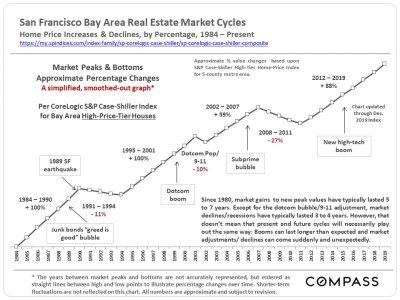

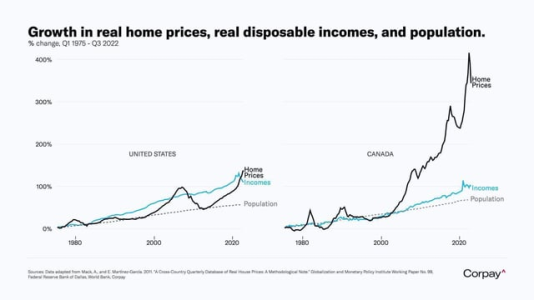

I understand the concept, but historically speaking, higher interest rates have meant homes are less affordable. Even with 17% interest rates in the 80's, the same home today at a 5% rate with a MUCH higher price is still a more affordable payment.They don't need to come down to this rate. Even if it's higher if you purchase a home at 6% rate and the rate drops to 4.25 rather than the 3.5 we had the first few years you save more than if you purchase at current rate and can never refinance. There is a reverse correlation between interest rates and home prices. When one goes up the other goes down and vice versa. It has always worked that way and will continue to do so.You're assuming rates will come back down to near these levels though. While it's possible, rates have NEVER been this low in the 50 years since Fannie Mae has been tracking them. Home prices have also been going up as rates have been going up as well, so it's possible that prices will come down slightly, but it doesn't appear that housing inventory has been able to keep pace with demand.

Even with current rates, homes are far from a bargain and are selling at 20 forward year earnings essentially like the stock market. It's getting overheated in many big markets like NYC where I live.

Personally, I believe the past 5 years will have a long lasting negative effect on housing due to people not wanting to move and give up their 3-4% rate, thus causing a backlog in housing churn.

thanks for the info.

thanks for the info.