- 4,758

- 1,409

- Joined

- Nov 6, 2012

3-6 Months of emergency funds.I work in LA but the places he's been looking at are in the San Fernando valley area.

After the 10k, nope. I need to save for that also. What's a good fallback amount?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

3-6 Months of emergency funds.I work in LA but the places he's been looking at are in the San Fernando valley area.

After the 10k, nope. I need to save for that also. What's a good fallback amount?

I work in LA but the places he's been looking at are in the San Fernando valley area.

After the 10k, nope. I need to save for that also. What's a good fallback amount?

Sorry if this question has been asked. I just didn't find the time to peruse the thread, but I am interested in investing in real estate later on in my life. But I know next to nothing about investing in real estate.

Would I have to become a sale agent or a broker to invest in properties? My local community college offers courses for those positions and I am interested. Is that a requirement.

Not really. It was being unfairly taxed with no representation in Britain.Which is ironic since this country went to war w/ Great Britain for being taxed too much.Crazy can't even give a gift without it being taxed.

The Internal Revenue Service announced the 2015 estate and gift tax limits today, and the federal estate tax exemption rises to $5.43 million per person, and the annual gift exclusion amount stays at $14,000.Oct 30, 2014

In your case, I would focus on paying off the student loans first since that should free up several hundred per month to save up for a down payment later on. Throw $9k at it to start with, keeping $1000 around for small emergencies. Then at least you'll have a guaranteed ROI.I work in LA but the places he's been looking at are in the San Fernando valley area.What part of LA are you in that you can get a $175k condo? Seems pretty cheap to me.

Do you have an emergency fund after the $10K too?

After the 10k, nope. I need to save for that also. What's a good fallback amount?

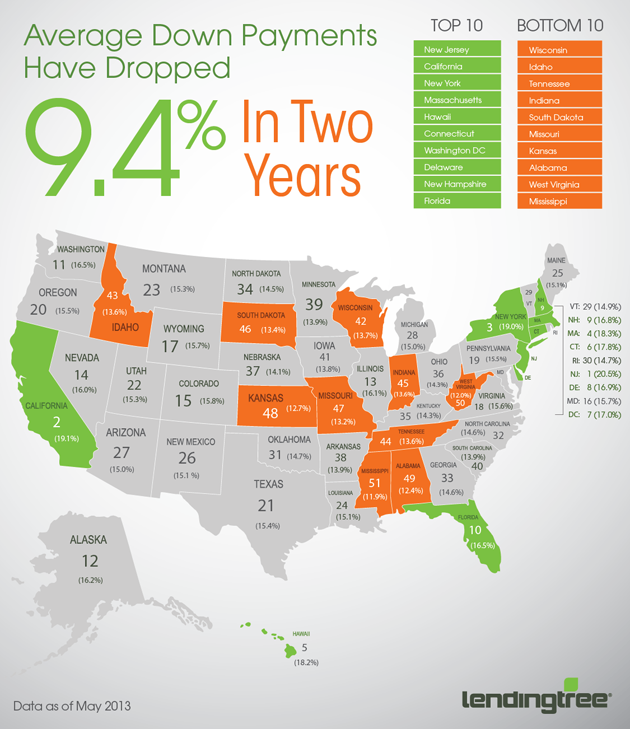

I'd like to know the actual percentage of people who are actually putting down 20% that are first time home buyers.

Google wins.

They're a lot of ways to look at it.

I think the bigger thing would be how many are singles vs couples.

A single person putting 20% down on a home is more impressive then a 2+ income household. That's why I when I hear people are able to save so much to reach a down payment, I see its a married coupled not individuals.

Those green areas have a lot of cash investors too. California is flush with Chinese investors and Florida & New York have lots of European investors.They're a lot of ways to look at it.I'd like to know the actual percentage of people who are actually putting down 20% that are first time home buyers.

Google wins.

I think the bigger thing would be how many are singles vs couples.

A single person putting 20% down on a home is more impressive then a 2+ income household. That's why I when I hear people are able to save so much to reach a down payment, I see its a married coupled not individuals.

Big ups to you. Definitely take advantage of that.feels good to have a VA loan no money down. bout to cop my first house

I was in the Army active duty.

Yea Beezy its a great benefit once you get out but it was created for a reason and that was to keep vets from being homeless like it was back in the days.

Look on the last few pages 20% down is not a requirement. 5% down minimum for Conventional.

My wife and I are looking for a home in Queens, NY now (first time home buyers). We don't want to go over 400k which is a challenge but can be done. It's that 20% down that a killer.

its even better once you get out. When i got out the Army I was going to school full time online and on campus at night and working during the day. I was collecting like 2k a month just to go to school and everything was paid for all i had to do was attend class even got paid for books if i was not working i could of gotten financial aid as well.

But life got in the way and now I'm purchasing a house and putting school on hold right now... Working with my realtor while I'm here... Will be in my new house if everything goes thru when i get back.

Im actually in the middle east right now working and all the things they say about the middle east are not true..

I recently went to Shake Shack out here check this out..

thinking about flying over to Dubai on a weekend

That Doha life. Nice. I'm here as well. Flying back to the States next week. I'll definitely be looking into using my VA loan in about a year or two.

g kind of snuck that in there to see if anybody knew what it was.

g kind of snuck that in there to see if anybody knew what it was.