antidope

Supporter

- 62,409

- 65,288

- Joined

- Jan 2, 2012

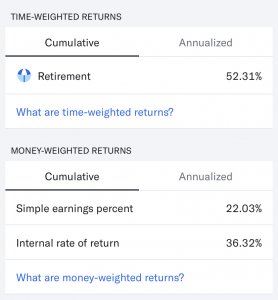

I like it. I use it as a supplement to my PA and run my IRA through there exclusively. They have a few features that I think really add value like the tax sensitive portfolio and a tax loss harvesting. 25 BPS is cheap too but I havent been subject to fees yet.How is Betterment as an investing account?