dblplay1212

Supporter

- 19,315

- 38,132

- Joined

- May 23, 2016

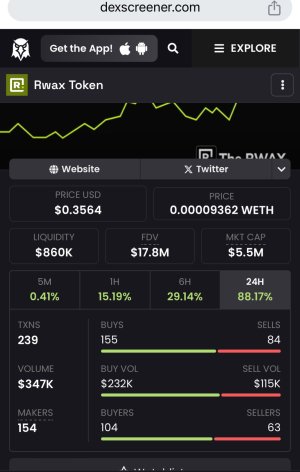

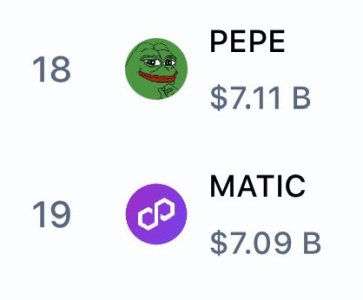

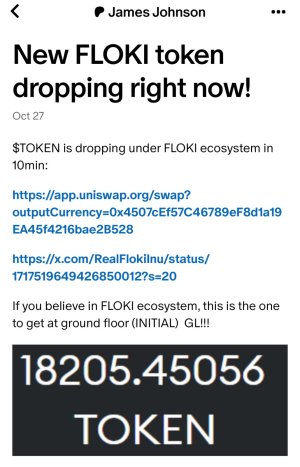

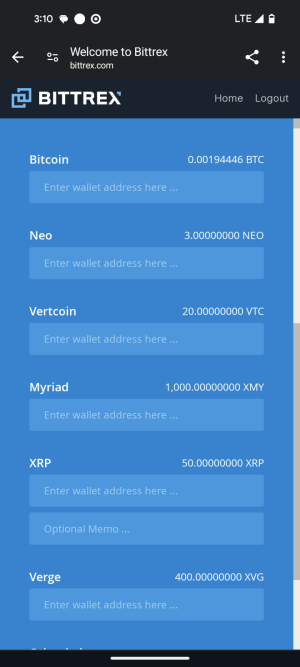

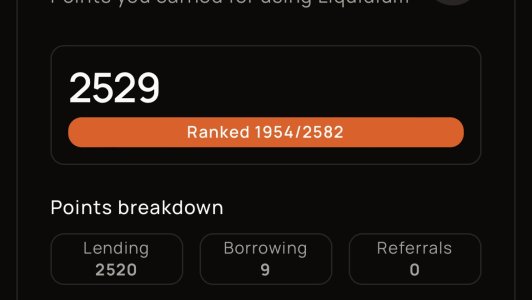

15% in 15 days seems a tad unrealistic long term. That's doubling your money every 2.5 months. Any explanation on how they are doing that? Wasn't there a similar deal a couple years ago that went belly up and everyone lose their money? Not trying to be a downer, just trying to look at it realistically.you have some $$ to spare, i suggest going into binance and staking/lending BUSD (binance stable coin)...u can subscribe to their 15day lock....you earn 15% straight up. Funds are locked, but you can pull out in 15days...worth it if u want to grow ur stack. Example: you stake 1k...in 15 days, you get back $1150.00

Last edited: