cs02132

Supporter

- 12,646

- 12,923

- Joined

- Nov 1, 2007

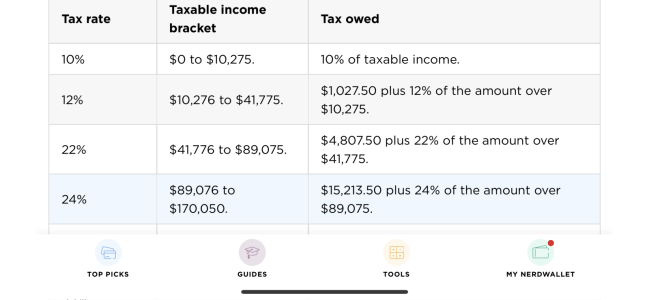

My boy has 4 kids and usually gets 10-12k but this year he’s barely getting 2-3k I think he said. It’s because of the child tax credits or whateverHearing people are getting shafted on taxes this year. Wondering what mine gonna look like

![Alien 0] 0]](/styles/default/xenforo/NTemojis/alien.gif)