- 1,563

- 1,828

- Joined

- Jul 27, 2012

What would it cost to add a door leading outside with a few steps ? I asked my broker and he said about $10K, which seems like a lot. He said you have to get an architect involved which is the most expensive part and then you have the actual materials and labor.

Depends on the exterior of the house (stucco or paneling, etc) and paint. Then there's the wall you want to add the door to. If there's wiring in the walls or if there are vents, if any additional structure needs to be added. But it should cost less than $10k. That's a bit much IMO. You can find a handyman or worker who can do it for a good deal.

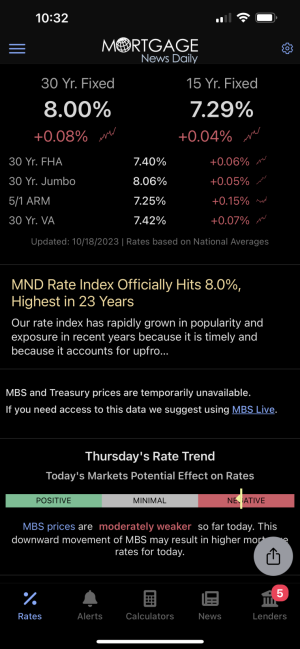

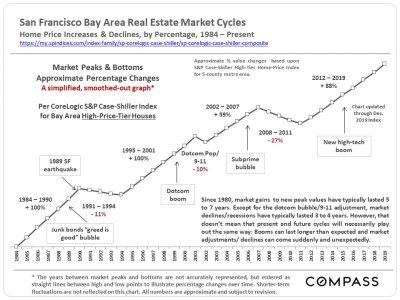

Everything is overpriced to the point where there's no profit to be made.

Everything is overpriced to the point where there's no profit to be made.