- 80,671

- 55,600

- Joined

- Nov 5, 2012

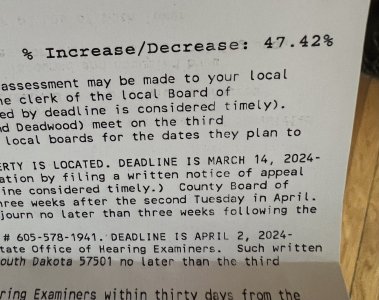

It’s 3 years now, she said the only way to remove is when it gets to 75 or 78%How old is your loan?

WF told me the same until it reached 2 years of age.

Now I have the appraisal done just waiting for things to button up

She said I could pay for an appraisal and they’d simply reject it so she suggested not to do it. She literally said “you’d just be wasting your time and money”