aepps20

Supporter

- 40,465

- 85,669

- Joined

- Feb 8, 2004

OMG! I've been looking at this house online for two weeks. It's just enough space for my husband and I. Not too expensive, considering this will be our first home. Has a big backyard for my dog. They're asking price is reasonable AND it's been on the market for over a year so I feel like there's probably room for negotiations. I FINALLY call the realtor today to ask some questions and schedule a time to go and see it. The realtor tells me that he loves the house and he was actually just there last week showing it >:

Anyways, I go to look at the listing online this afternoon, and it's OFF the ******* MARKET!

I'm seriously devastated.

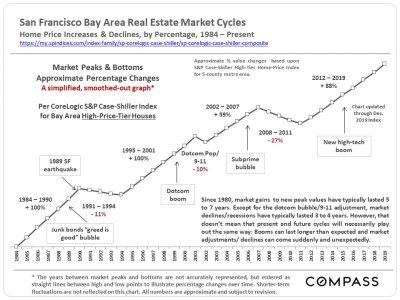

Was this your realtor? If so, it might be time to find a new one. I understand your frustration. About 3 years ago I was looking to buy my first home in Denver and I saw this really cool townhouse that was featured in the Colorado parade of homes, by the time my realtor got his act together I lost the house. I was very disappointed at the time but fast forward to 2016 and I'm about to get a brand new home that was better than the one I missed out on. The right house for you and your family will come around again.

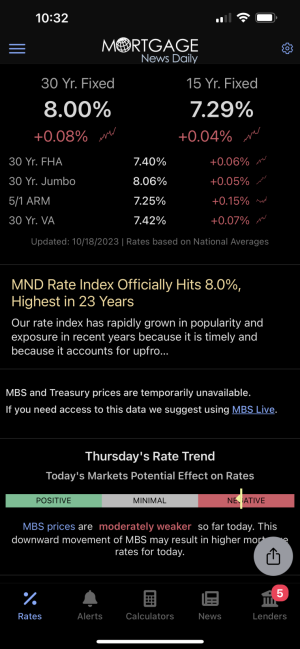

i'm happy with my % though, for now.

i'm happy with my % though, for now.