- 2,514

- 10

- Joined

- May 16, 2009

[h1]What percentile are y'all in?

[/h1] [h1]

[/h1] [h1]How Your Income Stacks Up[/h1]

by Kevin McCormally

Wednesday, December 23, 2009provided by

Where do you rank as a taxpayer? You may not feel rich earning $35,000 a year, but you're in the top half of taxpayers. Make $70,000, and you earn more than 75 percent of fellow taxpayers.

[table][tr][td]

http://content.kiplinger.com/tools/slideshows/slideshow_pop.html?nm=15TaxDeductions[/td] [/tr][/table]

Even as the Great Recession ends, we know the economic wounds it inflicted will take years to heal. The national unemployment rate has breached 10 percent, and unemployment is higher than 12 percent in California and above 15 percent in Michigan. A new study from the Department of Agriculture found that nearly 50 million Americans struggled at some point in 2008 to get enough to eat.

More than 40 million Americans are officially living in poverty. And you might be surprised at how little income it takes to not be considered poor by the federal government. For 2008, the poverty threshold for a single person under age 65 was an income of $11,201, or less than $1,000 a month. For a family of four, the threshold was $21,834. For a family of six, $28,76

With that perspective, you may wonder just how your income stacks up against that of your fellow citizens. New statistics from the IRS provide an answer. The numbers here come from an analysis of 2007 tax returns, the most recent ones that have been studied.

[table][tr][td]http://finance.yahoo.com/career-work

[/td] [/tr][/table]

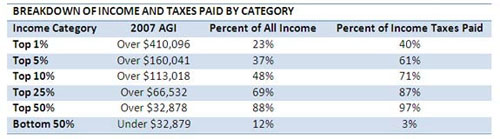

The data show that an income of $32,879 or more puts you in the top half of taxpayers. Earning a bit more than twice that much -- $66,532 -- earns you a spot among the top 25 percent of all earners. You crack the elite top 10 percent if you earn more than $113,018

And $410,096 buys top bragging rights: Earn that much or more and you're among the top 1 percent of all American earners.

Kiplinger has developed an online calculator to quickly show you -- based on your personal adjusted gross income -- into which income category you fall and, as a bonus, what percentage of the nation's tax burden is borne collectively by you and your fellow citizens who are in that income category. The following table shows the income categories and the percentage of income earned and tax burden paid by each category.

[table][tr][td]

[/td] [/tr][/table]

[/td] [/tr][/table]

Copyrighted, Kiplinger Washington Editors, Inc.

[table][tr][td][size=-2]ADVERTISEMENT[/size]

[/td] [/tr][/table]

[/h1] [h1]

[/h1] [h1]How Your Income Stacks Up[/h1]

by Kevin McCormally

Wednesday, December 23, 2009provided by

Where do you rank as a taxpayer? You may not feel rich earning $35,000 a year, but you're in the top half of taxpayers. Make $70,000, and you earn more than 75 percent of fellow taxpayers.

[table][tr][td]

http://content.kiplinger.com/tools/slideshows/slideshow_pop.html?nm=15TaxDeductions[/td] [/tr][/table]

Even as the Great Recession ends, we know the economic wounds it inflicted will take years to heal. The national unemployment rate has breached 10 percent, and unemployment is higher than 12 percent in California and above 15 percent in Michigan. A new study from the Department of Agriculture found that nearly 50 million Americans struggled at some point in 2008 to get enough to eat.

More than 40 million Americans are officially living in poverty. And you might be surprised at how little income it takes to not be considered poor by the federal government. For 2008, the poverty threshold for a single person under age 65 was an income of $11,201, or less than $1,000 a month. For a family of four, the threshold was $21,834. For a family of six, $28,76

With that perspective, you may wonder just how your income stacks up against that of your fellow citizens. New statistics from the IRS provide an answer. The numbers here come from an analysis of 2007 tax returns, the most recent ones that have been studied.

[table][tr][td]http://finance.yahoo.com/career-work

[/td] [/tr][/table]

The data show that an income of $32,879 or more puts you in the top half of taxpayers. Earning a bit more than twice that much -- $66,532 -- earns you a spot among the top 25 percent of all earners. You crack the elite top 10 percent if you earn more than $113,018

And $410,096 buys top bragging rights: Earn that much or more and you're among the top 1 percent of all American earners.

Kiplinger has developed an online calculator to quickly show you -- based on your personal adjusted gross income -- into which income category you fall and, as a bonus, what percentage of the nation's tax burden is borne collectively by you and your fellow citizens who are in that income category. The following table shows the income categories and the percentage of income earned and tax burden paid by each category.

[table][tr][td]

Copyrighted, Kiplinger Washington Editors, Inc.

[table][tr][td][size=-2]ADVERTISEMENT[/size]

[/td] [/tr][/table]

-

[table][tr][th="col"]

[/th] [th="col"]

[/th] [th="col"]

[/th] [/tr][tr][th="row"]

[/th] [td]

[/td] [td]

[/td] [/tr][tr][th="row"]

[/th] [td]

[/td] [td]

[/td] [/tr][tr][th="row"]

[/th] [td]

[/td] [td]

[/td] [/tr][tr][th="row"]

[/th] [td]

[/td] [td]

[/td] [/tr][tr][th="row"]

[/th] [td]

[/td] [td]

[/td] [/tr][tr][th="row"]

[/th] [td]

[/td] [td]

[/td] [/tr][/table]