- 27,552

- 39,626

- Joined

- Mar 14, 2010

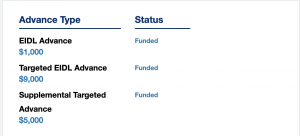

I definitely agree but it would be like applying for benefits which require children when you have no kids.

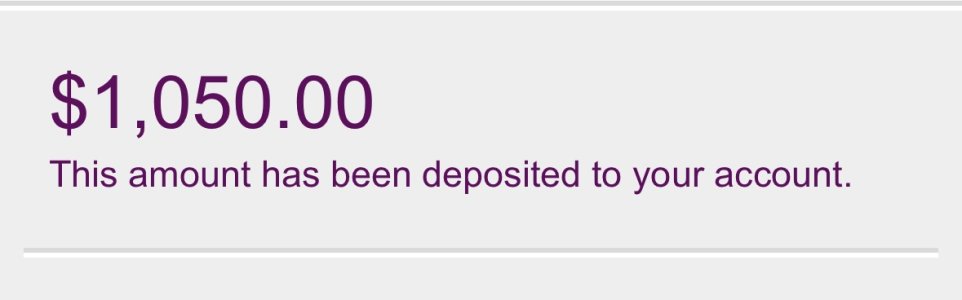

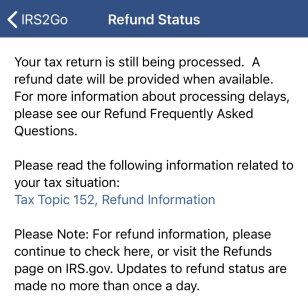

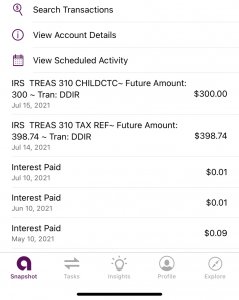

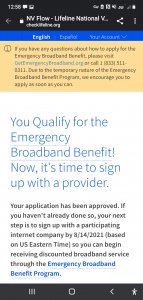

if they cared about kids, they wouldn’t cut educational spending and student loans wouldn’t be a high. Or they’d send stimulus checks again. They don’t care. When the start caring, so will I. Until then, get yours. Tax payers should get everything we deserve