- 13

- 10

- Joined

- Feb 1, 2017

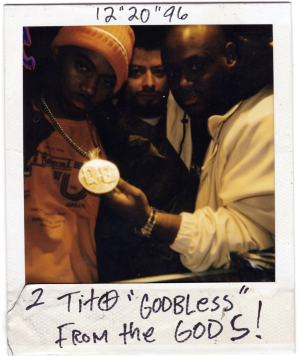

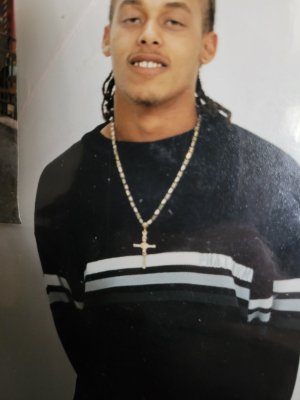

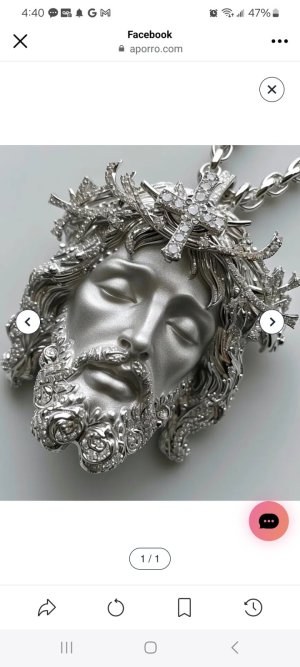

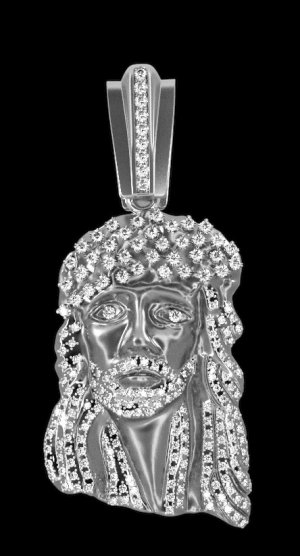

Was the chain too small or too big for the pendant?cool, it's more or less the same as my pendant which is 5 grams.

I copped a 2mm rope the other day but I just returned it because it wasn't really proportionate to the size of the pendant. Definitely looked off.

thanks man!