- 5,974

- 352

- Joined

- Aug 25, 2005

Wife and I pull in about 9-10K a month after taxes.....but

I pay:

$1200/month in daycare

$750 in car payments

$2300 in rent

$600 in utlities

$300 for car insurance

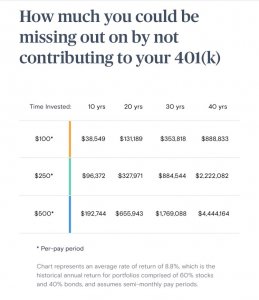

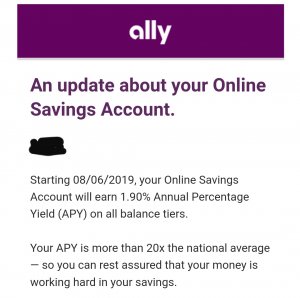

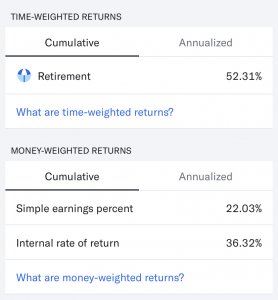

$600 to 401K and savings (kids already have 60k aside for college, so not saving much for that)

Plus gas, food, entertainment, etc...

Leaves us with about 3-4K a month and somehow we spend it. But in the last 2 years I have taken vacations to the mediterranean twice, been to Paris, Amsterdam, Prague, London as well.

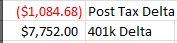

Can't take it with you...and somehow I manage to carry a credit card balance of aroud 5k all the time.

pay off that CC balance man!

and how old are your kids where you get to take that many vacations? damn you doin somethin right. I got 2 kids and I'm not going anywhere anytime soon. Last vacation I took was to Hawaii with the extended family last year and traveling with 1 kid (my 2nd wasnt born yet) was a hassle even with the help of my in laws.

I know where that extra $3-4K is going if your household is anything like my household. YOUR WIFE. I try to put everything on the CC every month (except mortgage+HOA fees) and then pay it off in full. That way its real easy for me to track and also get to stack CC rewards points for free. I need to 5 finger check my wife this month cause our statement is $9,700 this month. :x Looks like my kids are going to state school at best or they better get some scholarships.

)

)