- 34,982

- 16,878

- Joined

- Aug 4, 2005

I usually budget myself $120 a week for living expenses ($20 gas, $50 groceries, $50 spending money) aside from my $750 rent and $150 in utilities.

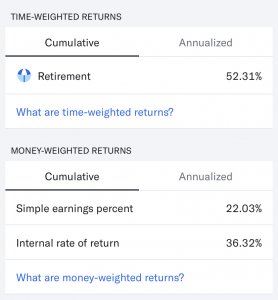

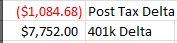

About $1100 a month into investment accounts, $500 into $401k (15% pre tax + company match), and $300 into a savings account with my bank (trying to build emergency fund slowly).

So far it's worked for me but I have a feeling I'll need to adjust accordingly. Especially since I just graduated college and this is all new to me I have a feeling that I need to contribute less to investment accounts and more into a savings just so I have some sort liquid to pull from

I have a feeling that I need to contribute less to investment accounts and more into a savings just so I have some sort liquid to pull from

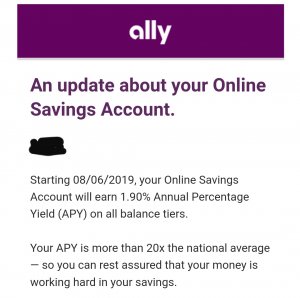

About $1100 a month into investment accounts, $500 into $401k (15% pre tax + company match), and $300 into a savings account with my bank (trying to build emergency fund slowly).

So far it's worked for me but I have a feeling I'll need to adjust accordingly. Especially since I just graduated college and this is all new to me

I have a feeling that I need to contribute less to investment accounts and more into a savings just so I have some sort liquid to pull from

I have a feeling that I need to contribute less to investment accounts and more into a savings just so I have some sort liquid to pull from