- 4,758

- 1,409

- Joined

- Nov 6, 2012

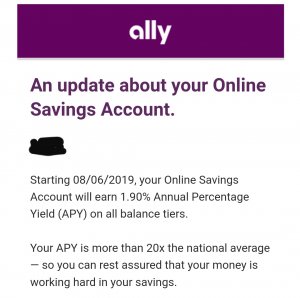

I use Barclay also very straight forward easy signup process , great user interface, and very secure. Take a look at their dream account it has very high APY, and it is great for a focused savings account ( saving for vacation, car, trip,house, etc).I use Barclay. 1.0% APY. I just transfer funds from my checkings over to it. No physical locations -- you may consider that a downside since you can't just walk into a location to handle issues.

I don't think it is a downside to not having a physical bank because, online banking is what gives you a higher APY than physical banks, and it gives you less direct access to the funds which is what you should want for a savings account.