- 74,620

- 24,040

- Joined

- Apr 4, 2008

fomc minutes playa

bunch of meaningless noise

great time to take off any positions you want to unwind though

you know you're holding dead premium when you can't take anything off into this rally

CTRL is a piece of **** how is it down right now

how is it down right now

bunch of meaningless noise

great time to take off any positions you want to unwind though

you know you're holding dead premium when you can't take anything off into this rally

CTRL is a piece of ****

how is it down right now

how is it down right now

Last edited:

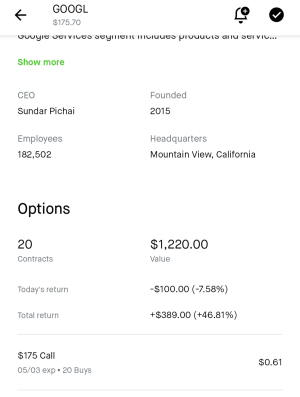

my 70-90-110 call fly looking decent. marking 3.75 from 2.90 entry. hopefully it doesn't go too bonkers before July expiration.

my 70-90-110 call fly looking decent. marking 3.75 from 2.90 entry. hopefully it doesn't go too bonkers before July expiration.