- 236

- 10

- Joined

- Mar 14, 2010

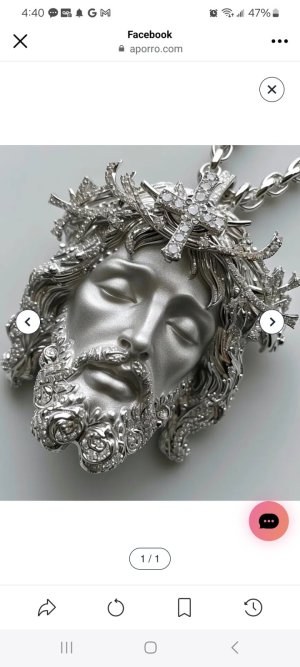

Originally Posted by MASERATI HARM

^^^^

@+@!# how do you know?

Ya'll "experts" crack me the %*@! up man ..

Ain't none of ya'll even been near these %$+#!@ to even see their jewels upfront ..

How the %*@! you know what's real or not by a picture ..

Hell some jewels prolly can't even tell with just their eyes alone ..

I damn sure know none of you dudes can tell ..

I never seem %$+#!@ put so much passion into what another @+@!# does with his money

This is exactly what I was trying to say but I decided to just leave it alone and not go back and forth with folks