- 8,335

- 6,956

- Joined

- Aug 22, 2012

Just got approved for the chase sapphire preferred. Looking forward to it.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

Keep in mind you also get lounge access and that priority pass which gives you credit to eat at certain food establishments every time you fly. For example, I flew down to LA a couple months ago with two friends and we were able to use alaska lounge prior to boarding which included all you can drink beer. Even though the annual fee is 450 on the sapphire reserved, if you use it correctly and take advantage of the perks its absolutely worth it.

chase freedom deff has nothing for travel i think u might be thinking chase saphirePlan on getting chase freedom as my next cc anybody have experience with it etc?

Looking into it right now but hoping it has a rewards system towards travel points. If not what do you recommend for travel points?

Plan on getting chase freedom as my next cc anybody have experience with it etc?

Looking into it right now but hoping it has a rewards system towards travel points. If not what do you recommend for travel points?

Plan on getting chase freedom as my next cc anybody have experience with it etc?

Looking into it right now but hoping it has a rewards system towards travel points. If not what do you recommend for travel points?

Just got an CLI on my Discover IT. Planning on applying for either Chase Freedom Unlimited or Amex Blue Cash Everyday sometime next month. Anyone suggest one or the other?

Need a report not score. My CCs give me my score for free

Need a report not score. My CCs give me my score for free

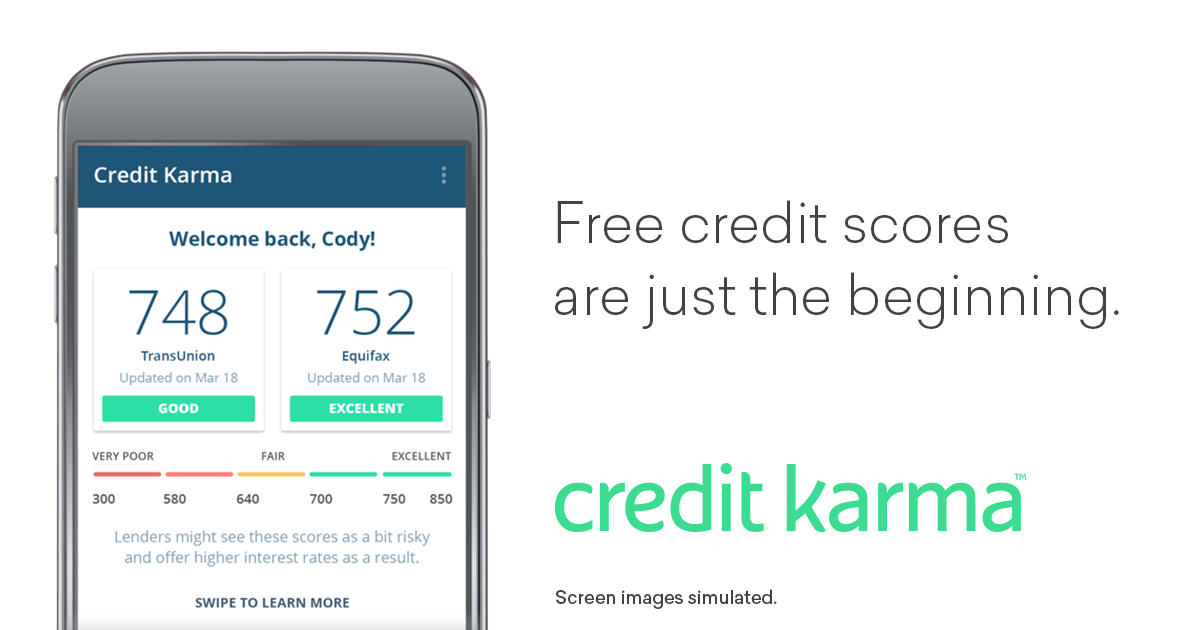

ThanksCredit karma actually gives your your report from transunion and equifax

Can you build credit with your bank? Im with TD

Thanks brodie. What i really meant to ask was do you guys recommend me starting my credit journey with my bank or with a separate card holder like capital one etc.?Do you mean building credit without a credit card?

TD has a few credit cards -- https://www.tdbank.com/personal/credit-cards.html

Thanks brodie. What i really meant to ask was do you guys recommend me starting my credit journey with my bank or with a separate card holder like capital one?

So I opened a credit card with a furniture store a couple of months back when I bought a mattress. The only reason I opened it was for the interest free financing for 6 months. If I close the card after the 6 months, will it impact my credit score?

Leave it open and don’t use it?So I opened a credit card with a furniture store a couple of months back when I bought a mattress. The only reason I opened it was for the interest free financing for 6 months. If I close the card after the 6 months, will it impact my credit score?