- 2,413

- 3,498

- Joined

- Jan 4, 2004

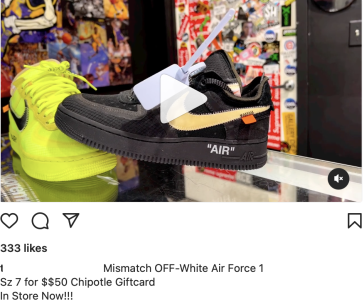

Adding a few more pictures. But to join the discussion, I also would rather have the Black Cement 4s Off -White next month than these.

The Sails are nice, but honestly for wearing purposes I’d rather have any of the OG 4 Colorways.

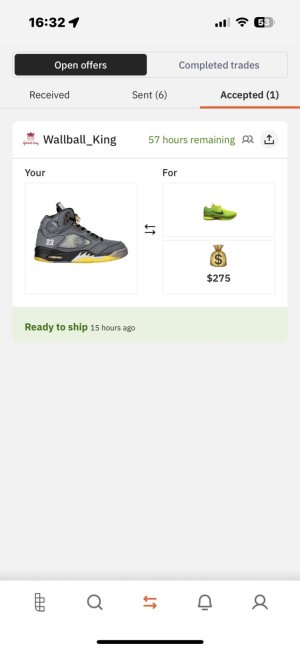

I’m holding on to these for trading purposes. If you didn’t get, not worth paying resell IMO.

The Sails are nice, but honestly for wearing purposes I’d rather have any of the OG 4 Colorways.

I’m holding on to these for trading purposes. If you didn’t get, not worth paying resell IMO.