- 2,875

- 4,915

- Joined

- Mar 29, 2020

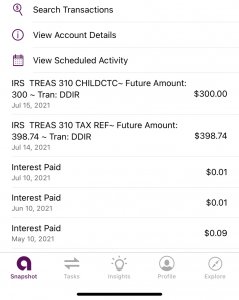

I Have a cousin get a irs letter this past week. He has a month to pay a couple thousand for an omission from 2018 taxes. Plus they added a couple hundred in interest. Never say never. Just a heads up

he had 1099-misc income from a reliable source that ended up showing the wrong ssn, so he didn’t claim it. Theee months back, the company corrected it and likely got the irs involved.

many folks who got that $600 unemployment bonus don’t realize that that was taxable. They may be in a new tax bracket above the threshold for other tax breaks or credits.

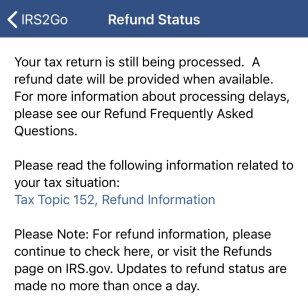

Dog I’m just now resolving an issue involving an erroneous duplicate 1099 that was reported in 2016.

**** took months. IRS tried slap me with $20K in taxes on unreported income, failure to pay penalties, and interest.

. But that smack was epic.

. But that smack was epic.