- 6,563

- 2,486

- Joined

- Mar 11, 2003

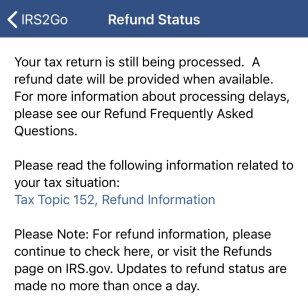

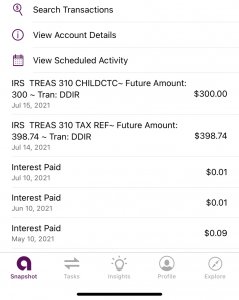

And no, you do NOT need to file that you didn’t receive it NEXT year.

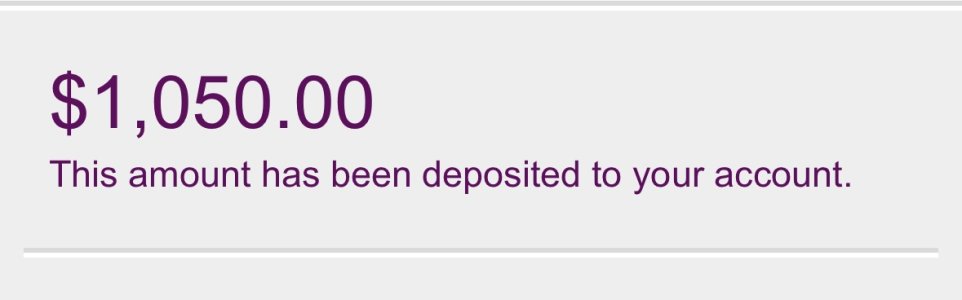

when filing on this years tax software there will be a brand new section for “Economic Relief”you will be prompted to enter the amount you received or 0 if you didnt receive it.

this literally impacts the refund showing in the tax software dollar for dollar.

if u were entitled to a 3000 return and report 0 when asked the amount u received in economic relief your refund will instantly shoot up to 4200.

when filing on this years tax software there will be a brand new section for “Economic Relief”you will be prompted to enter the amount you received or 0 if you didnt receive it.

this literally impacts the refund showing in the tax software dollar for dollar.

if u were entitled to a 3000 return and report 0 when asked the amount u received in economic relief your refund will instantly shoot up to 4200.