- 28,056

- 52,623

- Joined

- Apr 2, 2007

So the real question...

During this hard fork dip...

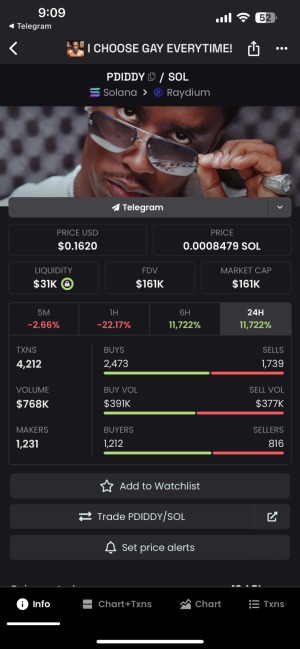

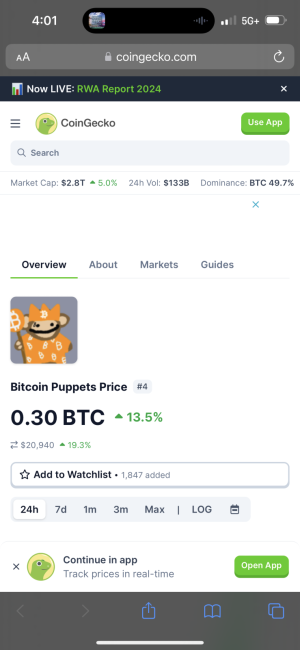

Buy Bitcoins or stock on this low *** alt coins...

I’m going to stock up..

Damn LTC hit $48..

During this hard fork dip...

Buy Bitcoins or stock on this low *** alt coins...

I’m going to stock up..

Damn LTC hit $48..

Last edited: