- 14,228

- 34,459

- Joined

- Jan 16, 2011

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

$900 is roughly what our tuition costs per year and that's for a very prestigious university.

A lotOut of curiosity what is the income tax rate on wages there?

A lot

A study from last year showed that the average single worker's net tax rate is 39%.

YeahI mean when you consider my HSA deduction, 401k, insurance for dental and health, and my metrocard pretax deduction, I see about 52% of my gross. So umm all in all we are paying the same **** honestly.

Texas’s deregulated electricity market, which was supposed to provide reliable power at a lower price, left millions in the dark last week. For two decades, its customers have paid more for electricity than state residents who are served by traditional utilities, a Wall Street Journal analysis has found.

Nearly 20 years ago, Texas shifted from using full-service regulated utilities to generate power and deliver it to consumers. The state deregulated power generation, creating the system that failed last week. And it required nearly 60% of consumers to buy their electricity from one of many retail power companies, rather than a local utility.

Those deregulated Texas residential consumers paid $28 billion more for their power since 2004 than they would have paid at the rates charged to the customers of the state’s traditional utilities, according to the Journal’s analysis of data from the federal Energy Information Administration.

The crisis last week was driven by the power producers. Now that power has largely been restored, attention has turned to retail electric companies, a few of which are hitting consumers with steep bills. Power prices surged to the market price cap of $9,000 a megawatt hour for several days during the crisis, a feature of the state’s system designed to incentivize power plants to supply more juice. Some consumers who chose variable rate power plans from retail power companies are seeing the big bills.

“If all consumers don’t benefit from this, we will have wasted our time and failed our constituency,” then-state Sen. David Sibley, a key author of the bill to deregulate the market, said when the switch was first unveiled in 1999. “Competition in the electric industry will benefit Texans by reducing monthly rates,” then-Gov. George W. Bush said later that year.

I mean when you consider my HSA deduction, 401k, insurance for dental and health, and my metrocard pretax deduction, I see about 52% of my gross. So umm all in all we are paying the same **** honestly.

I wouldn’t mind paying more taxes if I thought the money was being well spent

I mean when you consider my HSA deduction, 401k, insurance for dental and health, and my metrocard pretax deduction, I see about 52% of my gross. So umm all in all we are paying the same **** honestly.

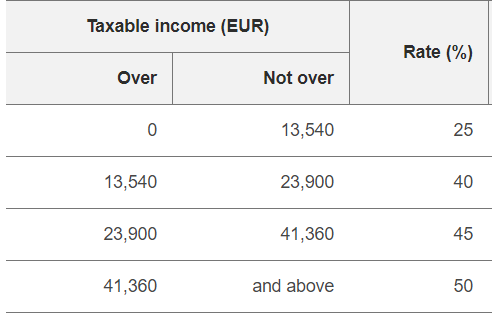

I’d probably need to know more about their exclusions from taxable income but I’m going to disagree here. If you told people here they are going to pay 50% tax on $40k of income they would riot. About 50% of Americans don’t pay federal taxes due to the standard deduction, tax credits, and adjustments to gross income. At that points it’s usually like a 3% state tax, 7.6% FICA taxes, maybe some more property taxes, and healthcare costs which are admittedly like $400-$800 a month which are ridiculous. We would be much better off trying to get healthcare and education costs down then overtaxing the **** out of everyone.

I’d say including 401(k) contributions in there is a bit disingenuous as it’s voluntary tax advantaged savings.

I don't think he argued that the tax system shouldn't be progressive.I’d probably need to know more about their exclusions from taxable income but I’m going to disagree here. If you told people here they are going to pay 50% tax on $40k of income they would riot. About 50% of Americans don’t pay federal taxes due to the standard deduction, tax credits, and adjustments to gross income. At that points it’s usually like a 3% state tax, 7.6% FICA taxes, maybe some more property taxes, and healthcare costs which are admittedly like $400-$800 a month which are ridiculous. We would be much better off trying to get healthcare and education costs down then overtaxing the **** out of everyone.

I’d say including 401(k) contributions in there is a bit disingenuous as it’s voluntary tax advantaged savings.

I don't think he argued that the tax system shouldn't be progressive.

I make a six-figure salary, my effective tax rate shouldn't be the same as someone making 1/5 of what I make.

Nor should my effective tax rate be the same as someone that makes five times more than I do

People at the lower end of the income bracket should pay less to have access to the same services as folk at the upper levels of the income bracket

I don’t disagree here at all, I’m just disagreeing with the notion that we are paying tax on 50% of our income indirectly. For instance the average work in Denmark pays an effective tax rate of 45%. So say you make 100k a year you are paying $45k in taxes there. The last data I saw was the average effective tax rate for federal and FICA was about 14% then add in a couple percent for state. Taxing like they do in European countries would lead to a pretty large increase in effective taxes. Generally speaking we could probably fix a hell of a lot of problems by raising the corporate rate to like 25%, bump up the highest individual rate back to Obama era levels, and stop spending so much on defense and policing on a federal and state level.

Im not arguing that the federal system shouldn’t be progressive. It’s highly progressive and it should arguably be even more progressive for the middle class. I’m saying the tax brackets posted before where people making 40k a year pay 50% in income taxes would be a ridiculous tax increase on the middle class.

It’s not progressive when I can invest in capital assets and pay 15% federal rate when my effective tax rate should be 30%

Sidenote, since Social Security was mentioned, I must say I absolutely hate talking to 50 something-year-old conservatives about it.

Buffoonery from every angle

Me: Social Security is gonna run out of money to pay full benefits in like 15 years, what should the country do?

Conservative: They need to fix it by the time I retire. I earned it

Me: So are you in favor of higher payroll taxes?

Conservative: No

Me: How about getting rid of the income cap on the payroll tax?

Conservative: No

Me: Increasing the benefit age?

Conservative: No

Me: Reducing the benefits?

Conservative: No

Me: Letting in way more immigrants so we have more workers paying into the program?

Conservative: No

Me: Reduce inequality to rebuild the middle-class tax base?

Conservative: No

Me: Commit to full employment economics to have more taxpayers?

Conservative: No

Me: Deficit spending to fund the difference?

Conservative: No

Me: What do you want to do then?

Conservative: I want them to fix it so I can get it when I retire

I mean you are talking about capital gains here which are two entirely different things. Capital gains are generally taxed at a lower rate because that income has already been taxed at a corporate level so they reduced the capital gains rate to eliminate a portion of double taxation on that income. Regardless of the rationale it was stupid and should just be taxed at ordinary rates.

But our tax system is highly progressive.

Tbh I’m fine with our tax rates. A significant part of that funds our social security and excellent affordable healthcare and education.