CrownRoyalDaddy

formerly tdoggy57

- 4,726

- 2,966

- Joined

- Nov 12, 2015

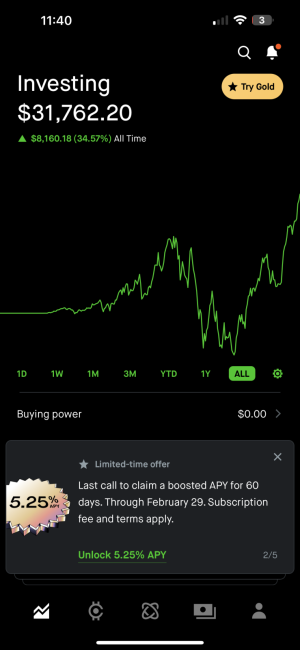

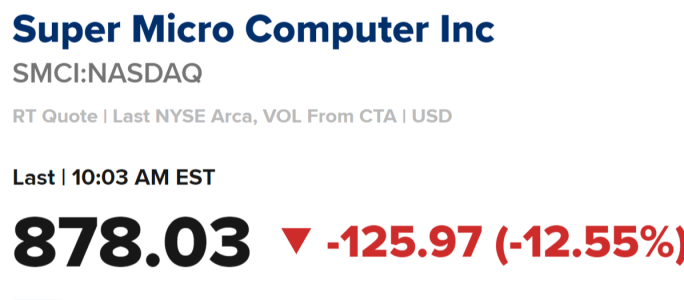

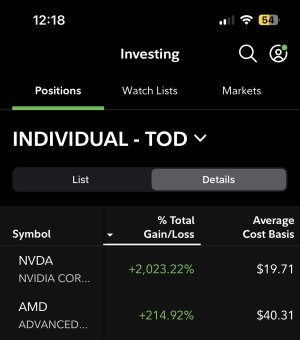

I don't know if AAPL has been disappointing, or if my perspective has been ruined by runners like NVDA. My appl bag is 5x bigger than my nvda bag, and I've been carrying aapl in my port for far longer than nvda, yet as of this morning, my nvda returns for a few months have eclipsed my aapl returns for the year.

All I know is that Cook and company better be cooking up next year or I just might start trimming.

...

Apple is always going to see much slower growth with their huge market cap

...are you seeing this somewhere, or just pure speculation?

...are you seeing this somewhere, or just pure speculation? I'm sorry, but this is hilarious. You're completely overthinking this. "you've lost much of your average cost" because it went from $300 to $305?

I'm sorry, but this is hilarious. You're completely overthinking this. "you've lost much of your average cost" because it went from $300 to $305?