- 4,286

- 4,334

- Joined

- Jul 20, 2012

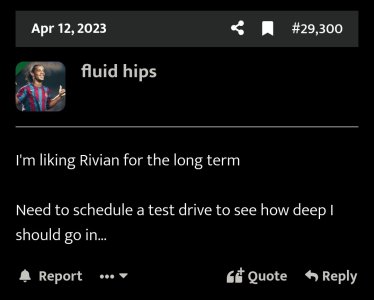

China will continue to tank but other countries will buy the dip

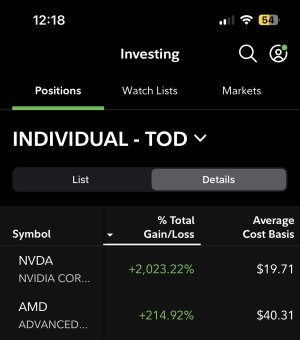

my position on LK is getting trashed at the moment I’m just lowering my cost average at the moment and starting a new position on AMD in February

my position on LK is getting trashed at the moment I’m just lowering my cost average at the moment and starting a new position on AMD in February

)

)