- 1,734

- 447

- Joined

- Jan 22, 2006

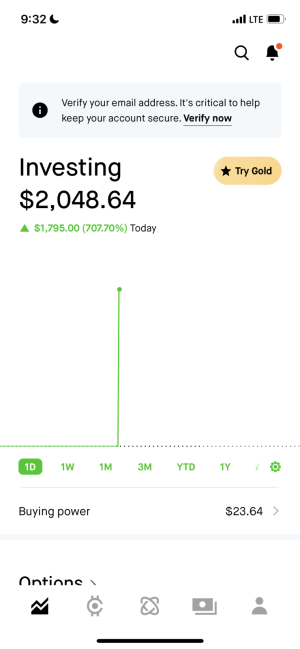

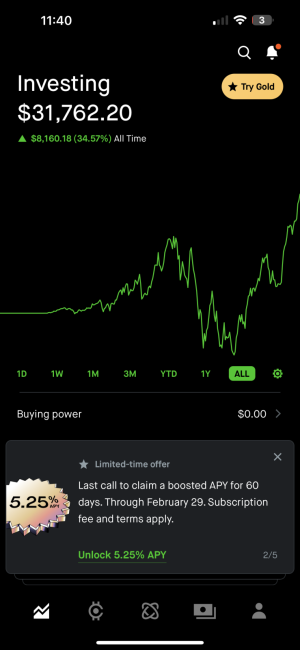

If you’re investing it’s not as bad since you likely won’t need to exit the position in a pinch but like in March RH was constantly down so there’s that. I’d just keep it there and continue hodl’ing but any new purchases I’d make in a new account. It’s important to have multiple accounts anyway.

reason for this?

You are insured up to a maximum $ if your bank goes under? I'm assuming its the same in the states.