- 21,217

- 11,812

- Joined

- Oct 10, 2005

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

You know if all you’re looking for is a double, you could buy a real company that isn’t a meme right?

. I can’t even say anything because he’s seeing his portfolio getting big enough to buy a second rental.

. I can’t even say anything because he’s seeing his portfolio getting big enough to buy a second rental.I hope for his sake he cashes in sooner rather than later and knows this isn't normal. I knowNot gonna lie, my buddy is making a killing off these WSB picks. I can’t even say anything because he’s seeing his portfolio getting big enough to buy a second rental.

I hope for his sake he cashes in sooner rather than later and knows this isn't normal. I knowjohnnyredstorm and I have lurked WSB for years, and it has NEVER been this easy for those degens to win. And it's not because of extra DD or someone unlocking some secret. It's this market, which is a once in a lifetime experience. And this will RUIN people before it's over. GME might be a legit squeeze and some damn fine work done by a handful of very influential people. BB? BBBY? PLTR? Nah, those arent it. Its luck and gambling. Survivors bias. No one should look at this past 9 months of market action and think that it's this easy, or it'll continue. The rug pull, and there is always a rug pull, will be more brutal than I think I've ever seen in my life.

Thank you coming to my TED Talk.

You know if all you’re looking for is a double, you could buy a real company that isn’t a meme right?

These meme stocks is like selling dope. **** flips fast, and I need a beach house by April. Dont come between me and my dream.

You’ll be homeless by March but good luck fam.These meme stocks is like selling dope. **** flips fast, and I need a beach house by April. Dont come between me and my dream.

That perspective famA lot of people out here on a pipe dream. This WSB YOLO groupthink is toxic man. Sure there a few big winners but then you have people losing their life savings trying to make quick flips.

I worked so hard to get where I’m at I’m more focused on NOT losing than winning. Some of these people see the potential win and are turning a blind eye to the potential loss (especially with options trading). Some real degenerate gambler behavior.

Was in at 14 and out at 18. Mistake. Some good DD on Twitter for it as a quick read.Anyone in on SKLZ?

My DD has been very preliminary. Will deep dive more.

Thoughts anyone?

Was in at 14 and out at 18. Mistake. Some good DD on Twitter for it as a quick read.

Sold out of TGT, trimmed JMIA and FTCH. Sell when you CAN not when you HAVE TO. Down to just 15 shares in those 2 and I'll hold that through any down turns. I trimmed because of parabolic moves and because their TAM isn't the entire planet, but I'll add back on weakness. FTCH is a great company but it's luxury fashion which isn't a necessity in theory, and JMIA has no business being up here tbh. They NEED to raise cash and if they don't I'm going to exit at $100. Also bot more HAACU.

FB really intrigues me and I may be a buyer after hours. Oppenheimer says Shops can add 25-50 billion in revs, WhatsApp is finally being monetized, Oculus is entering the main stream. Think this is a $2 trillion MC in 10 years.

This is why I tell people not to look at their accounts every day. I have fallen back into the habit of doing so and I hate it. Why am I looking at 20-year money every day? Just going to create bad habits and be obsessed with small movements that mean nothing in the grand scheme of things. I used to only look when it was time to add money and then check performance then and that was it.PLTR is like 60% owned by retail or something ridiculous. It’s a legit company but it’s a meme for the ****s there. BB could be a good turn around story potentially. But if all your goal is is to flip a double, you’re not thinking big enough with a vision. You think all I wanted was a double when I bought PINS in January? I said at minimum it should be trading at the same price TWTR was (a double) and thought it could be a 100 stock. If you’re creating wealth you should be looking for the best opportunity to make the most amount of money and compound over time. A double is cool for a flip, but when you’re using rocket emojis for trash *** Nokia and praying for BB at $35, you’re doing it wrong. I’ve never once HOPED a trade was going to work out for me since March. I did my DD, and I managed my risk and I reacted to price. Hoping is for losers who just started with no process, plan or conviction. Be a winner.

Not gonna lie, my buddy is making a killing off these WSB picks. I can’t even say anything because he’s seeing his portfolio getting big enough to buy a second rental.

Look at what WeChat brings in as a potential compI'm not sure people realize the monster WhatsApp can be once they start monetizing

I actually look everyday to make myself numb to it so I don't even agonize over it. At this point, anything in size for me is what I view as. 20 year hold and potential 10 bagger, so if we tank, we tank, and I use my cash to buy more. I've really trimmed down to just what I want to own forever, at sizes I'm comfortable seeing a 50% haircut at, with only like 2 or 3 tiny lotto plays (HEC, MMEDF, ZNTE) that add up to one full low conviction holding.This is why I tell people not to look at their accounts every day. I have fallen back into the habit of doing so and I hate it. Why am I looking at 20-year money every day? Just going to create bad habits and be obsessed with small movements that mean nothing in the grand scheme of things. I used to only look when it was time to add money and then check performance then and that was it.

They must be moving their money to SPCE this time around

It’s moving crazy

I don’t want any part of that

SPCE is moving because of the potential it'll be in the yet to be created ArkX.

Any time the market looks like it might seeing heavy selling I get out of DKNG and then nothing happens and I have to buy backMy manjohnnyredstorm always sells out of DKNG too early. I took enough losses on this one, probably gonna forever hold.

Hope AMD does me right soon. Want to add more CURI.

I've made money on it every time, but I'm ok with being out of it here, I want the cash position it gives me. My whole process has been refocused now to trying to own companies where their TAM could be the entire planet. That's where my highest conviction will be and then on a smaller scale, I look for the bet growth opportunities like DKNG, FTCH, JMIA, etc. I like those companies a lot long term, but when I need to add cash, I feel safest pulling from them to keep perspective.

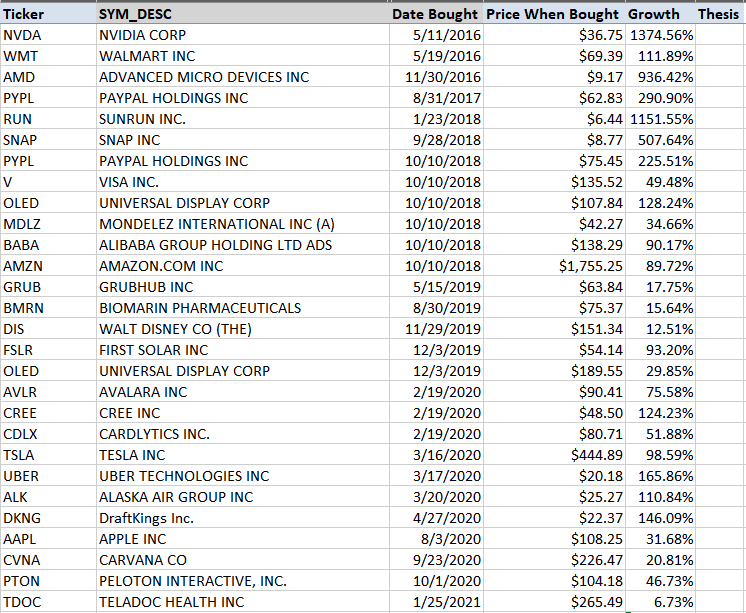

I've made money on it every time, but I'm ok with being out of it here, I want the cash position it gives me. My whole process has been refocused now to trying to own companies where their TAM could be the entire planet. That's where my highest conviction will be and then on a smaller scale, I look for the bet growth opportunities like DKNG, FTCH, JMIA, etc. I like those companies a lot long term, but when I need to add cash, I feel safest pulling from them to keep perspective. Solid list, this is the way to do things long term. Gonna steal this from youPeople make the game way harder than it needs to be. I finally took the time to make an update to my watchlist today, and these are just the initial buys; no avg basis or notional values for obv reasons. You just buy quality names and sit back and it will take care of itself.

Some stuff in here I will be getting rid of, like I bought Mondelez cause I love Oreos stuff like that makes no sense.