- 249

- 44

- Joined

- Jul 26, 2002

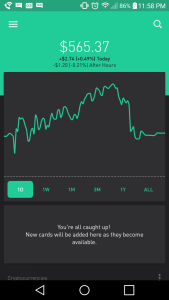

Am I the only one who buys stocks of companies I use?

I made a killing off Facebook, Rite Aid, Under Armour and Tmobile last year. FB and RAD more than doubled

Also my strategy and it has worked well for me. Nike, Costco, Southwest Airlines, BofA, Twitter, Apple. Need QT to go public.

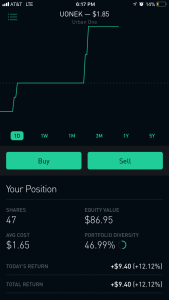

Should've known better

Should've known better