- 10,915

- 2,735

- Joined

- Apr 30, 2011

Crap. Didn't realize RetailMeNot's ER is tomorrow morning. Thought it was Friday. Was gonna buy puts......

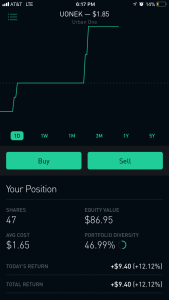

Gold is getting shaky.....might have to dip out of NUGT soon

still dont know how that thing went public............ dot-com bubble 2.0 is reals

Word. Their market cap's at 1.8B

Played EGLT instead of the other 2 IPOs, sold out at 12 for a 30 cent a share loss. Didn't like the action.

Played EGLT instead of the other 2 IPOs, sold out at 12 for a 30 cent a share loss. Didn't like the action.